Evergy Inc. reached a settlement with activist investor Elliott Management Corp. that includes appointing two new directors to the utility’s board.

The agreement also includes the creation of a special committee to “explore ways to enhance shareholder value,” the Kansas City-based company said Monday in a statement. Evergy shares rose 3% before the start of regular trading in New York.

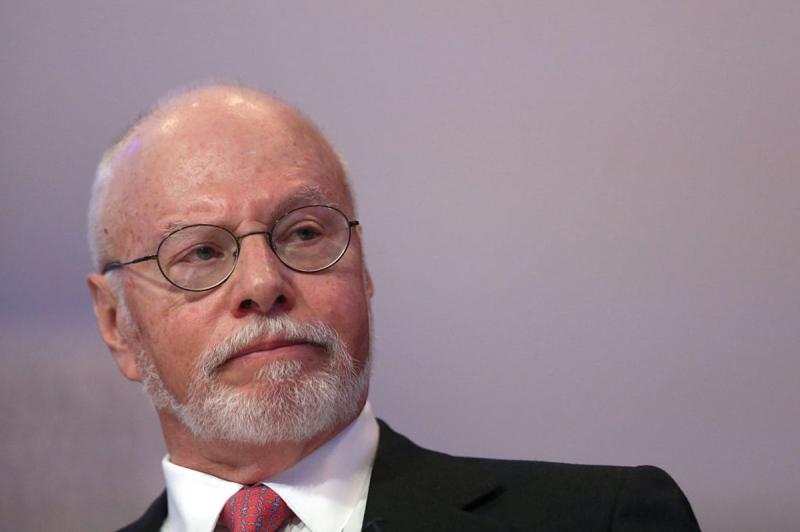

Elliott, the New York hedge fund run by billionaire Paul Singer, disclosed a $760 million stake in Evergy in January and urged to company to replace some of its existing management and board.

The activist investor wanted Evergy to develop a plan to invest more in its infrastructure. Elliott also pressed the utility owner to overhaul its leadership or explore a merger.

Elliott has a history of pushing for changes at some of the world’s largest and most recognizable companies, including AT&T Inc., EBay Inc. and Pernod Ricard. The hedge fund recently has taken stakes in utility owners including Sempra Energy. It has also built a position in Twitter Inc. and is said to plan a push to replace Chief Executive Officer Jack Dorsey.

The push for change at Evergy came less than two years after the utility was created out of a merger of Westar Energy Inc. and Great Plains Energy. Evergy supplies energy to about 1.6 million customers in Kansas and Missouri, according to its website.

As part of the agreement with Elliott, former Energy Future Holdings Corp. Chief Executive Officer Paul Keglevic and Kirk Andrews, chief financial officer at NRG Energy Inc., will join the board.

Evergy will also halt its share repurchase program and increase its five-year investment plan to $7.6 billion through 2024, up from a previous target of $6.1 billion through 2023, according to a separate statement.

Source: Bloomberg

Can’t stop reading? Read more

Fund Friday: Top fundraising news in private equity

Fund Friday: Top fundraising news in private equity Aquilius Investment Partners, a...

KKR powers past $723bn AUM on record fundraising and historic investment pace

KKR powers past $723bn AUM on record fundraising and historic investment pace KKR & Co. posted...

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio Ardian has...