The consortium that won the bid to acquire Thyssenkrupp’s elevators division wants to spend billions of euros on expanding the business, a manager at one of three partners said in remarks published on Sunday.

“The is no shortage of money for a global expansion,” Ranjan Sen, managing partner with private equity firm Advent told the Handelsblatt business daily. “This could by all means amount to single-digit billions.”

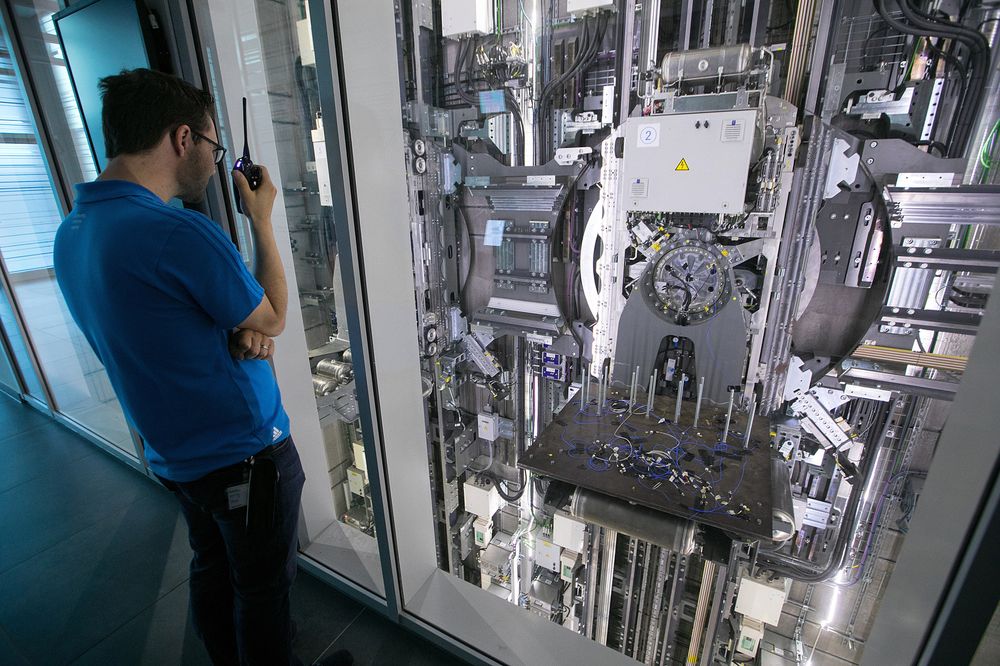

Thyssenkrupp (TKAG.DE) said on Thursday it had agreed to sell its elevators division to a consortium of Advent, Cinven and Germany’s RAG foundation for 17.2 billion euros ($18.96 billion).

Thyssenkrupp said it would reinvest about 1.25 billion euros to take a stake in the unit.

By far the German conglomerate’s most profitable business, Thyssenkrupp Elevator is the world’s fourth-largest lift manufacturer behind United Technologies Corp’s (UTX.N) Otis, Switzerland’s Schindler (SCHP.S) and Finnish rival Kone (KNEBV.HE).

Source: Reuters

Can’t stop reading? Read more

Fund Friday: Top fundraising news in private equity

Fund Friday: Top fundraising news in private equity Aquilius Investment Partners, a...

KKR powers past $723bn AUM on record fundraising and historic investment pace

KKR powers past $723bn AUM on record fundraising and historic investment pace KKR & Co. posted...

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio Ardian has...