Accelerating its growth in real estate credit, Carlyle announced today that its Global Credit platform has agreed to acquire iStar’s net lease business for an enterprise value of approximately $3bn. Equity will come from a combination of Carlyle’s Global Credit platform and a minority balance sheet investment from Carlyle.

Through the transaction, Global Credit will gain a diversified portfolio of triple-net leases spanning industrial, office and entertainment properties across 18.3 million square feet located throughout the United States. In addition, iStar’s net lease investment team overseeing the portfolio, including Barclay Jones who has led iStar’s net lease strategy for more than 20 years and Senior Vice President Catherine Tenney, will join Carlyle’s Real Estate Credit team.

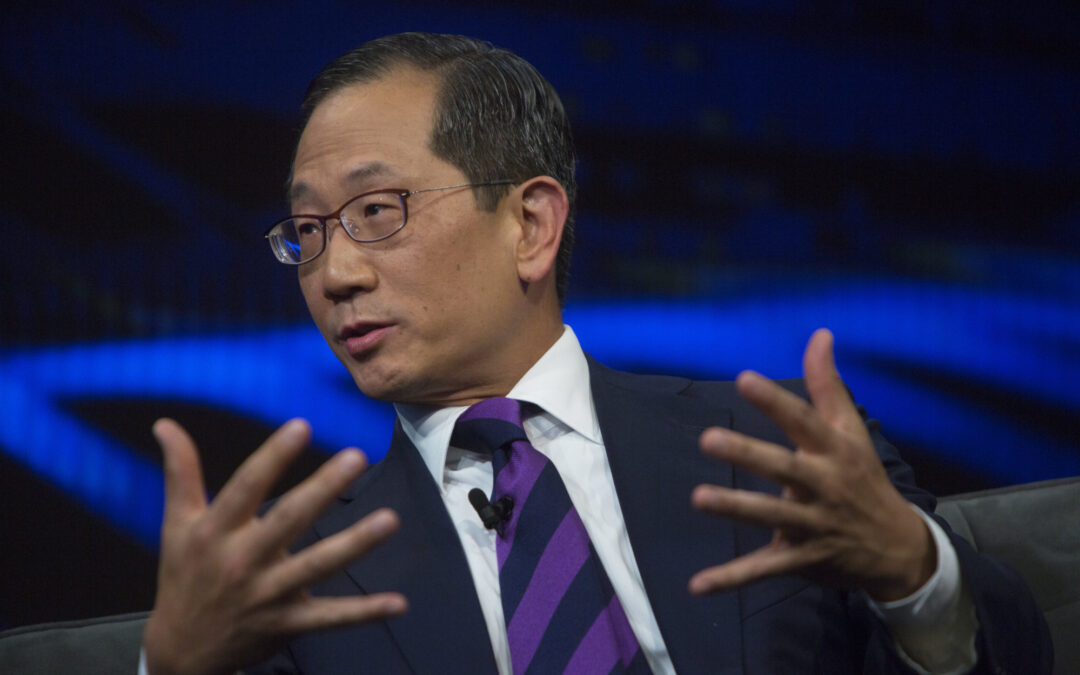

Mark Jenkins, Head of Global Credit at Carlyle, said, “Acquiring iStar’s net lease business jump starts our real estate credit strategy, quickly giving us scale to accelerate deployment. We expect to grow this net lease strategy into a $10bn business with a focus on making the product available to the retail channel over time. We set out to grow the Global Credit platform in part by expanding into adjacent, scalable areas and this is another example of how we are delivering.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

Jay Sugarman, iStar Chairman and Chief Executive Officer, said, “The sale of our net lease portfolio is the culmination of a highly successful investment strategy for iStar and the result of the outstanding efforts of our net lease team, led by Barclay Jones and Catherine Tenney. We are pleased to sign an agreement that will recognize the value that we have built up over many years and that will enable the team to continue taking advantage of opportunities in the net lease space on behalf of Carlyle and its investors.”

Roger Cozzi, Carlyle’s Head of Real Estate Credit, served as iStar’s CIO and co-head of its investment committee from 1995 to 2007 and played a key role in the acquisition of a significant portion of its net lease portfolio.

Cozzi said, “iStar has a proven track record of success in sourcing and structuring net leases and has curated and actively managed this portfolio over the past two decades. I look forward to reuniting with the team, and to leveraging Carlyle’s vast resources to build on the strong foundation this portfolio creates as we escalate the growth of our broader real estate credit business.”

Last year, Global Credit made its first fund investment in the net lease arena by agreeing to provide up to $300 million in growth capital to New Jersey-based Four Springs Capital Trust.

This acquisition is part of Carlyle’s strategic plan to scale its Global Credit platform, which grew to a record $66 billion in AUM as of the third quarter 2021, more than two times larger than it was less than four years ago. It has been Carlyle’s fastest-growing segment over the past three years.

The transaction is expected to close in the first quarter of 2022 and is conditioned upon the satisfaction of certain customary closing conditions.

Source: Press Release

Can’t stop reading? Read more

PAI and ICG strike €3bn Infra Group deal with partial stake sale

PAI and ICG strike €3bn Infra Group deal with partial stake sale PAI Partners has partially exited...

Blackstone snaps up East Miami luxury hotel amid hospitality deal spree

Blackstone snaps up East Miami luxury hotel amid hospitality deal spree Blackstone has purchased...

Bain Capital strikes $3.9bn deal to sell China data centre arm amid AI boom

Bain Capital strikes $3.9bn deal to sell China data centre arm amid AI boom Bain Capital has...