Multistrategy investor Coatue Management has amassed at the very least $6.58bn to date for its fifth growth-investment technique and probably extra from a feeder fund, regulatory filings present.

The New York agency, which additionally operates hedge funds and venture-capital automobiles, mentioned its Coatue Growth Fund V LP had collected capital from 692 buyers. It additionally reported a $3.21bn gross worth for its Coatue Growth V Offshore Feeder Fund LP. The agency mentioned in a submitting that the feeder fund is invested fully within the growth fund, with out specifying whether or not the reported quantities overlap.

Coatue didn’t reply to a request for remark. The agency reported managing about $59.45bn in internet consumer belongings as of the top of final 12 months.

The agency additionally has listed different automobiles which have raised cash for the Growth V technique, together with Coatue Growth Fund V Private Investors LLC, which listed a worth of $1.64bn and 1,833 buyers, and Coatue Growth Fund V Private Investors Offshore LP, which had a complete of almost $1.22bn from 976 buyers, separate securities filings present.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

One investor within the technique, Taiwan-listed Fubon Financial Holding Co., deliberate to decide to Coatue’s offshore feeder fund by an insurance coverage unit, in keeping with a regulatory submitting in Taiwan. Fubon Life Insurance is investing $65m within the Coatue growth fund, in keeping with DealStreet Asia.

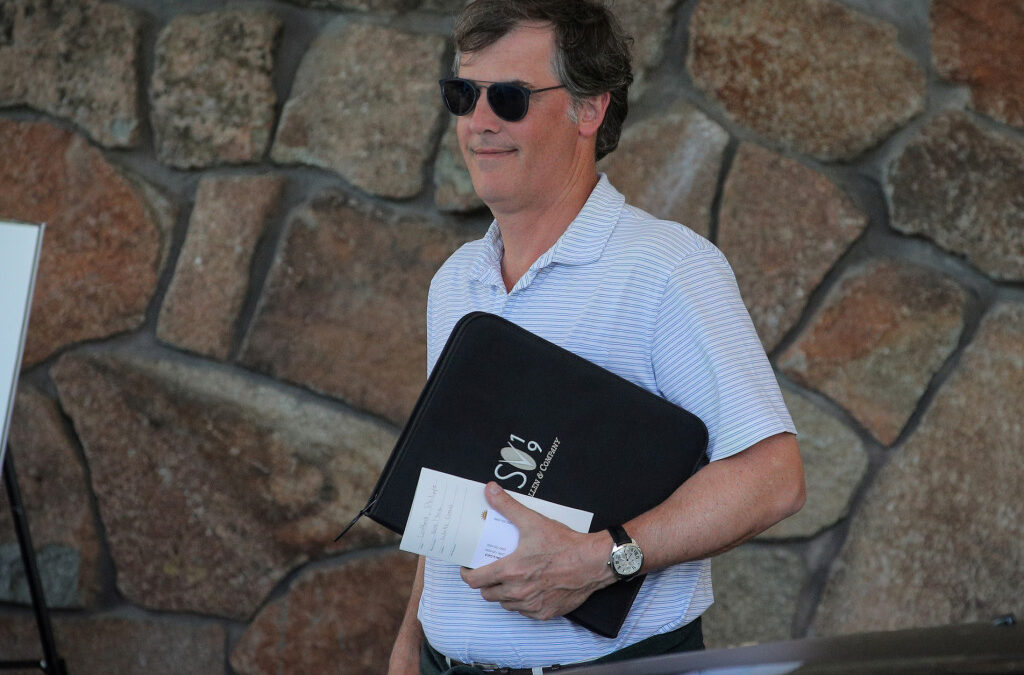

Coatue, which was arrange by brothers Thomas and Philippe Laffont in 1999, additionally mentioned in its latest annual report back to the Securities and Exchange Commission that its fourth growth fund had about $8.94bn. The agency mentioned it launched Coatue Growth Fund IV LP in 2019 and the fifth growth fund in March 2021.

The methods concentrate on mid- to late-stage personal corporations, and in some instances early-stage companies, in keeping with the agency’s most up-to-date annual investment-adviser report.

Recent offers involving Coatue embody a $65m funding in Michigan-based electricity-storage firm Our Next Energy Inc., led by BMW i Ventures, and a $100m Series C spherical that Coatue co-led for Tackle.io Inc., a Boise, Idaho, maker of enterprise functions utilized in advertising and marketing and gross sales.

Some of the capital within the growth methods is drawn from buyers’ hedge-fund accounts, Coatue mentioned. It mentioned about $78.9m of hedge-fund capital has been dedicated to the fifth growth fund.

Source: Pehal News

Can’t stop reading? Read more

August Equity makes move into legal sector with Higgs investment

August Equity makes move into legal sector with Higgs investment August Equity has taken a stake...

Fund Friday: Top fundraising news in private equity

Fund Friday: Top fundraising news in private equity Neuberger Berman is approaching the first...

Blackstone set to win Warehouse REIT takeover after Tritax concedes

Blackstone set to win Warehouse REIT takeover after Tritax concedes Blackstone is poised to secure...