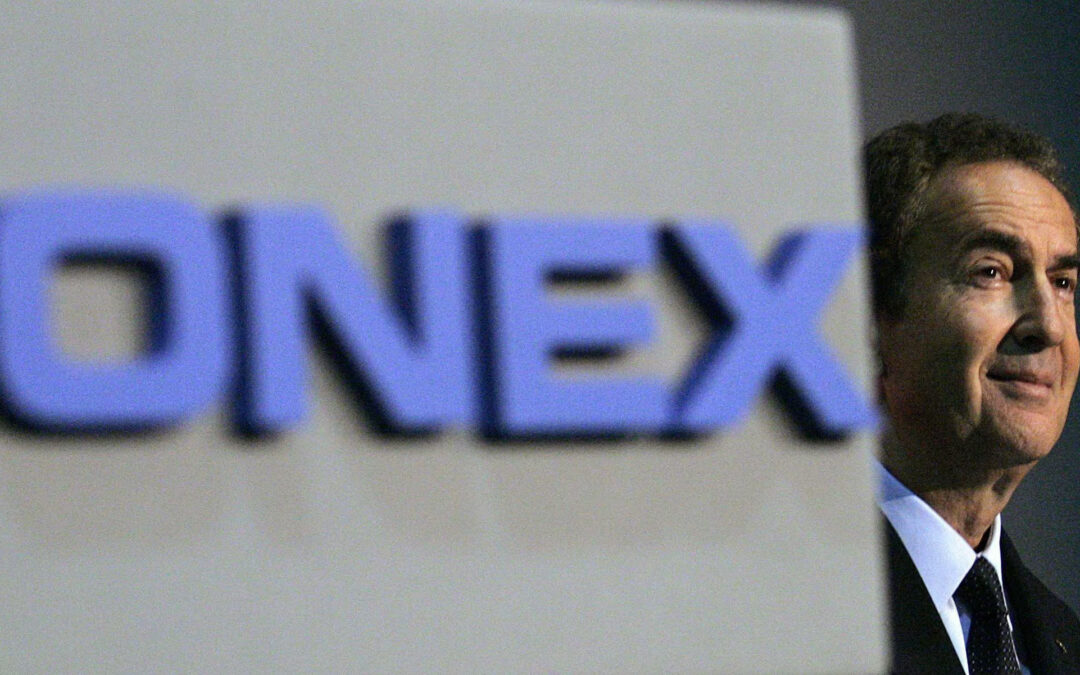

Canadian investment firm Onex Corp. is evaluating options including a potential sale of UK health-care staffing business Acacium Group, according to people familiar with the matter.

The Toronto-based company is working with advisers at Bank of America Corp. to help identify potential suitors for the business, the people said, asking not to be identified as the information is private. London-based Acacium could be valued at about $1.5bn or more in a sale and is likely to draw interest mostly from buyout firms, the people said.

Deliberations are in the early stages and no final decisions have been made, the people said. Onex didn’t respond to requests for comment. A spokesperson for Bank of America declined to comment.

Demand for staffing in health care has increased, especially after the coronavirus pandemic, prompting investors to seek exposure to the industry. Acacium provides doctors, nurses and technicians, as well as services, to hospitals and other health agencies. Onex acquired the business in 2020 from another private equity firm, Towerbrook Capital Partners, for an undisclosed amount.

Onex this year paused fundraising for its flagship vehicle as rising interest rates and fears of a recession curbed investors’ risk appetite. Raising money for large private equity funds is the “most difficult the industry has ever seen,” Chief Executive Officer Bobby Le Blanc said in September.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

Acacium Group is a leading provider of healthcare staffing solutions in the UK. They have been providing temporary and permanent staffing solutions to the NHS and private healthcare sector for over 40 years. Acacium Group has a network of over 30,000 healthcare professionals, including nurses, doctors, technicians, and therapists. They also provide a range of other services, such as workforce planning, payroll, and training.

Acacium Group is committed to providing high-quality care and is proud of its reputation for providing excellence in healthcare staffing. They are also committed to innovation and are constantly developing new ways to improve their services.

Source: BNN Bloomberg

Can’t stop reading? Read more

Fund Friday: Top fundraising news in private equity

Fund Friday: Top fundraising news in private equity Aquilius Investment Partners, a...

KKR powers past $723bn AUM on record fundraising and historic investment pace

KKR powers past $723bn AUM on record fundraising and historic investment pace KKR & Co. posted...

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio Ardian has...