If you think we missed any important news, please do not hesitate to contact us at [email protected].

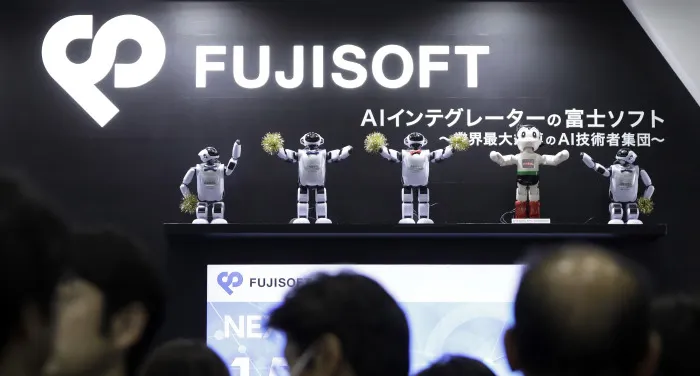

Through FK Co., an entity owned by KKR-managed investment funds, the global investment firm has signed a Memorandum of Understanding with the founding family of FUJI SOFT to support the transaction.

The deal follows KKR’s earlier stake acquisitions via two tender offers.

The proposed buyout includes a share consolidation that will result in FK and NFC Corporation becoming the sole shareholders of the company. This “Squeeze-out” process will be put to a vote at an Extraordinary General Meeting of Shareholders scheduled for 25 April 2025.

Following the Squeeze-out, FUJI SOFT plans to repurchase shares held by NFC. This step, expected after early June 2025, will result in FK acquiring 100% ownership of the company.

The move underscores KKR’s ongoing interest in Japan’s technology sector and its strategy of taking public companies private to drive operational transformation.

If you think we missed any important news, please do not hesitate to contact us at [email protected].