Top private equity news of the week

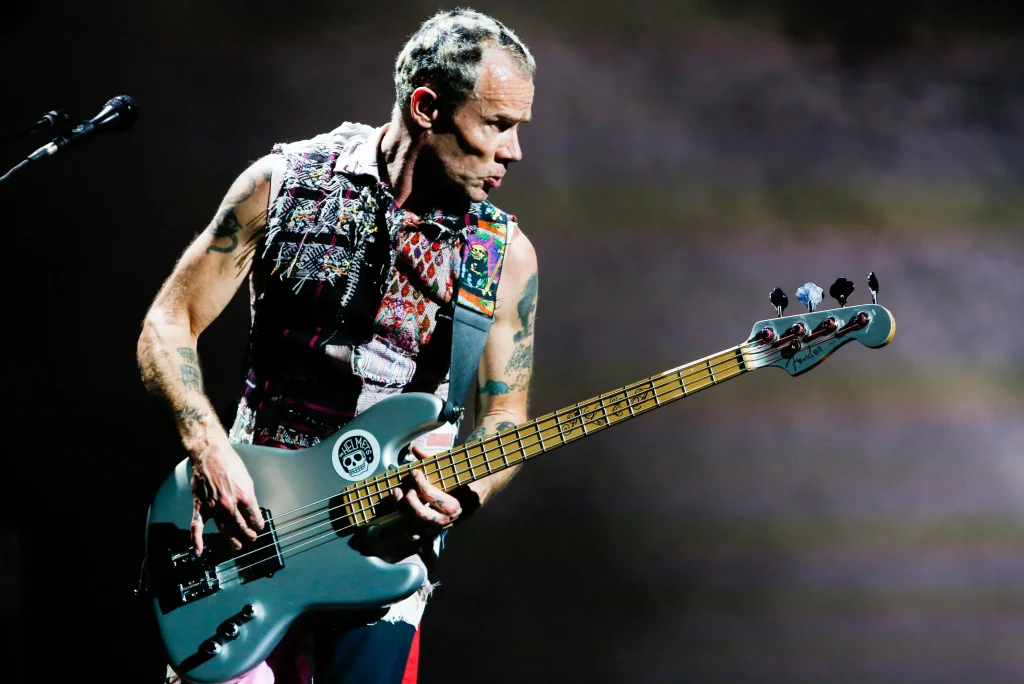

Warner Music and Bain Capital have joined forces in a $1.2bn joint venture aimed at aggressively acquiring music rights, with their first major target being the Red Hot Chili Peppers’ catalogue in a deal valued at over $300m.

Talks to acquire the rock group’s iconic repertoire, including hits like “Californication”, are ongoing. While a deal is not yet finalised, it would mark a significant win for the newly launched JV, which plans to deploy “multibillions” more in the coming years.

Read more here.

BlackRock has completed its acquisition of HPS Investment Partners, significantly expanding its footprint in private credit and establishing a new integrated platform, Private Financing Solutions (PFS), with $190bn in client assets.

The transaction positions BlackRock to respond to growing investor demand for flexible private and public credit strategies, particularly as market dynamics shift more financing from traditional banks to capital markets. With HPS joining forces with BlackRock’s $3tn public fixed income business, the firm now aims to offer clients and borrowers seamless solutions across the credit spectrum.

Read more here.

Triton has finalised its acquisition of Bosch’s security and communications technology product business, which will now operate as Keenfinity Group.

The deal underscores Triton’s continued focus on carve-outs from European industrial giants and its strategic push into growing sectors such as building technologies and professional audio systems.

Read more here..

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.

Can`t stop reading? Read more