TA, H.I.G., and KKR alumni launch Altaline to target tech and financial services deals

Altaline Capital Management, a newly launched private equity firm based in Los Angeles, has entered the market with a clear mandate: to back lower middle-market companies in the technology, business services, and financial services sectors across North America.

The firm was founded by professionals with prior tenures at TA Associates, H.I.G. Capital, and KKR. Altaline is focused on control-oriented buyouts and growth investments, targeting founder-led companies at key inflection points such as geographic or digital expansion, operational scaling, and AI enablement.

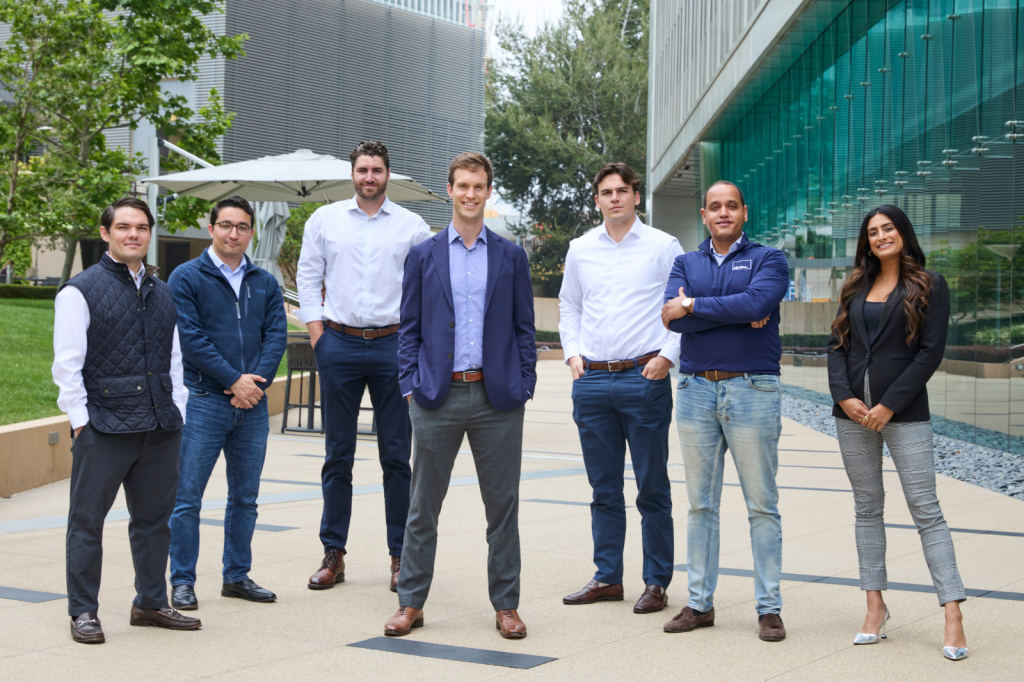

Nearly half of Altaline’s seven-member team is dedicated to operational support, reflecting its commitment to working hands-on with portfolio companies. “Our team’s experience at leading global investment firms has instilled in us a disciplined investment philosophy and a passion for building enduring businesses,” said principal Brian Maher.

Managing director Ian Balmaseda emphasised the firm’s collaborative and involved approach: “We strive to be trusted partners who roll up our sleeves and work alongside management to unlock value and achieve shared success.”

Altaline is actively seeking new investment opportunities and is positioning itself as a strategic partner to entrepreneurs navigating rapid growth and transformation.

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.

Can`t stop reading? Read more.