CapitalG and Nvidia in talks to back Vast Data at $30bn valuation

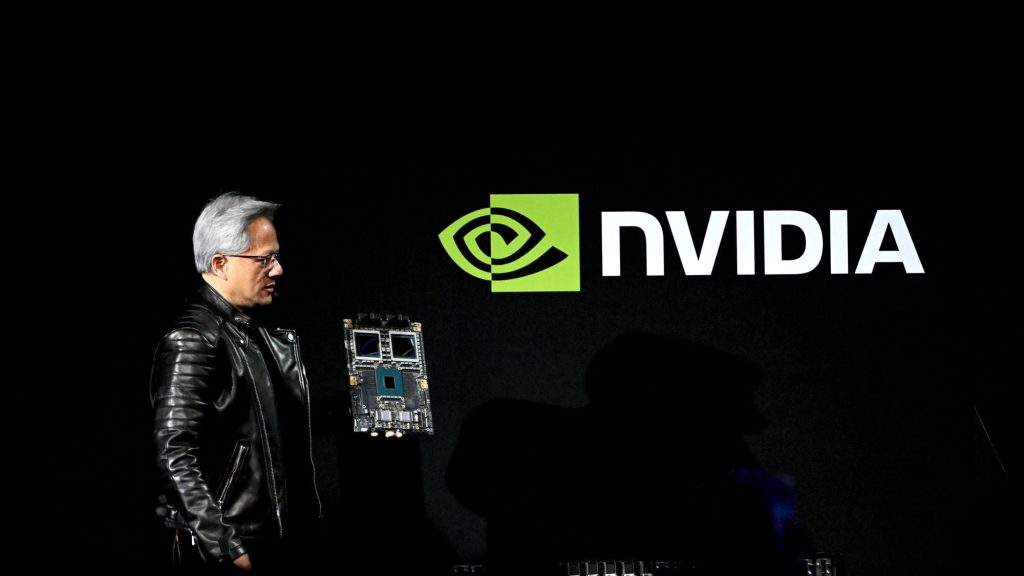

Alphabet’s growth equity arm, CapitalG, and Nvidia are reportedly in advanced talks to participate in a multi-billion-dollar funding round for Vast Data, in a transaction that could value the AI-focused infrastructure provider at up to $30bn, according to Reuters.

If completed, the deal would mark one of the largest private financings in the AI infrastructure sector to date. The round is expected to include a mix of strategic investors, private equity firms, and late-stage venture backers, with closure anticipated in the coming weeks.

Based in New York, Vast Data provides high-performance, flash-based data storage and management solutions optimised for AI workloads. Its architecture is designed to maximise throughput across GPU-powered systems, including those built on Nvidia technology. Its customer base includes xAI, the Elon Musk-founded AI firm, and CoreWeave, a fast-growing AI compute provider.

Vast Data is reportedly free cash flow positive and currently generates $200m in annual recurring revenue (ARR), with expectations to scale to $600m by 2026, according to sources familiar with the company’s financials. The company raised its last funding round in 2023 at a $9.1bn valuation and has raised around $380m in total to date.

The latest financing round also follows the recent appointment of former Shopify CFO Amy Shapero to Vast’s executive team, a move widely interpreted as preparation for a potential IPO.

Analysts view Vast Data’s proprietary software-defined flash architecture as a leader in the space, ahead of rivals such as Weka and DDN. With demand for scalable AI data infrastructure accelerating, bankers and institutional investors consider the company a high-value strategic asset.

Shares of Alphabet and Nvidia declined slightly following the news, down 1.4% and 2.3% respectively on Friday.

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.

Can`t stop reading? Read more.