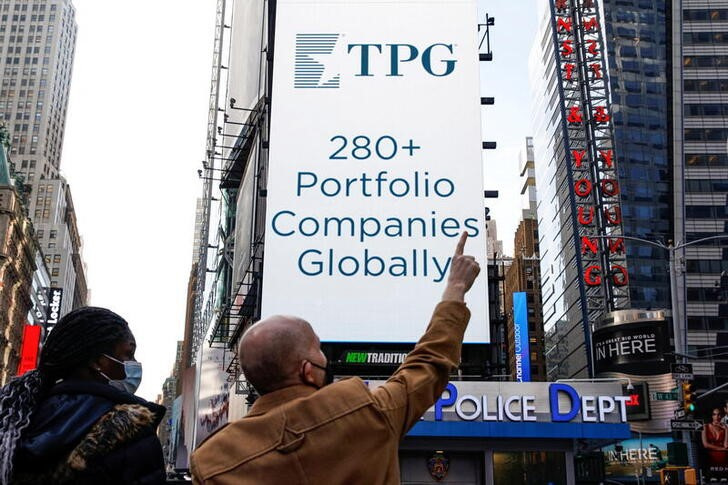

TPG anchors launch of Vanara, ex-employee-led tech growth investor

TPG is anchoring the launch of Vanara Capital, a new San Francisco-based investment firm founded by former TPG executives Neil Kamath and Hayden Lekacz, according to Bloomberg.

The firm will target growth-stage technology companies across software, internet, and tech-enabled services, with equity investments ranging from $10m to $50m in businesses generating at least $15m in revenue.

Vanara has entered a strategic partnership with TPG Next, TPG’s platform for backing emerging managers, which will serve as anchor investor in its debut fund and hold a minority stake. Acrisure CEO Greg Williams is also an investor in the inaugural vehicle.

Kamath and Lekacz, who previously worked together at Spectrum Equity and TPG’s tech adjacencies unit, have invested in companies including Reddit and ServiceTitan. They emphasise a tailored approach, providing growth capital, founder liquidity, or M&A support to fit each company’s needs.

“We see that the growth-stage market has suffered from this complacency, where there’s a cookie-cutter approach to growth-stage investing,” Kamath said. “We’re looking to offer a new, more capital solutions-oriented approach to partnering with best of breed entrepreneurs.”

Vanara’s name comes from a Sanskrit term for mythological beings that help heroes overcome challenges before fading into the background, reflecting the founders’ philosophy of supporting entrepreneurs while letting them lead.

TPG Next, led by COO Anilu Vazquez-Ubarri, will provide Vanara with access to capital, operational support, and introductions to potential LPs. TPG has previously seeded firms including Cohere Capital, Demopolis, and Ardabelle Capital.

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.

Can`t stop reading? Read more.