Ashton Kutcher joins board as Soho House buyout value climbs to $2.7bn

Soho House, the global private members’ club and hotel group, is set to go private in a $2.7bn deal backed by US-based MCR Hotels, according to The Guardian.

The deal will see shareholders receive $8.08 per share in cash, representing a 37% premium to the company’s share price before the buyout proposal. The agreement has been unanimously approved by Soho House’s board and is expected to close in the fourth quarter of 2025, pending shareholder approval.

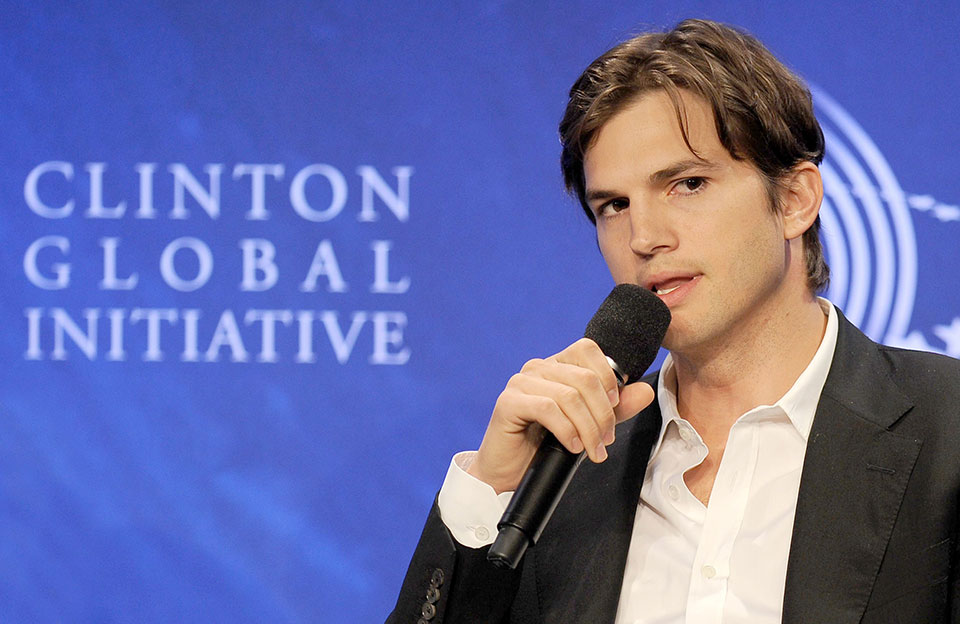

As part of the company’s next chapter, actor and tech investor Ashton Kutcher is set to join Soho House’s board. Kutcher, known for his roles in venture capital and technology, will be joined by business partner Guy Oseary, adding new commercial weight to the business. The pair are entering as shareholders, although financial details of their involvement were not disclosed.

Soho House, which operates 43 clubs worldwide, floated on the New York Stock Exchange in 2021 under the name Membership Collective Group. The IPO valued the business at $2.8bn, but the company has since faced shareholder criticism over its continued losses and complex governance structure. Despite narrowing its net losses from $221m in 2022 to $117m in 2023, the firm had not yet reached profitability by the time of the latest offer.

The business is also contending with a broader slowdown in the premium hospitality market, with signs of waning demand for luxury hotel stays and upscale restaurants. This has created pressure on high-end lifestyle brands like Soho House to recalibrate and reposition under private ownership.

If you think we missed any important news, please do not hesitate to contact us at [email protected].

Can`t stop reading? Read more.