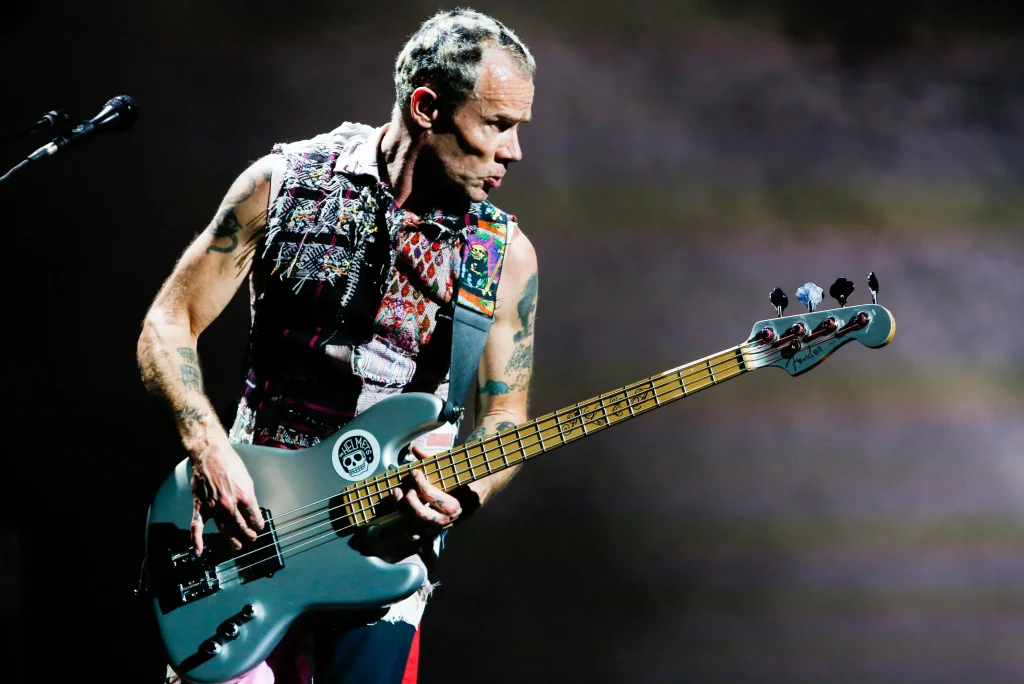

Bain and Warner Music launch $1.2bn JV, eye $300m Red Hot Chili Peppers catalogue acquisition

Warner Music and Bain Capital have joined forces in a $1.2bn joint venture aimed at aggressively acquiring music rights, with their first major target being the Red Hot Chili Peppers’ catalogue in a deal valued at over $300m.

Talks to acquire the rock group’s iconic repertoire, including hits like “Californication”, are ongoing. While a deal is not yet finalised, it would mark a significant win for the newly launched JV, which plans to deploy “multibillions” more in the coming years.

Warner Music chief executive Robert Kyncl said the joint venture brings together Warner’s “deep expertise” with Bain Capital’s “financial prowess” to make them “the destination of choice for pre-eminent catalogues.”

Each party will contribute half of the $1.2bn in equity. Warner will manage marketing, distribution, and administration of acquired catalogues, while Bain returns to the music space after previously helping take Warner private in 2004.

The venture comes amid increased activity in music rights, as private equity and institutional investors continue to treat catalogues as a stable and scalable asset class. Apollo, for example, backed Sony Music’s $1bn acquisition of Queen’s catalogue in 2023.

Despite rising interest rates, the market for music catalogues has proven resilient. According to Shot Tower Capital, catalogues traded at 17.4x net royalties in 2024, slightly down from the 2022 peak of 18.8x but significantly above 2019’s 13.7x multiple.

Angelo Rufino, partner at Bain Capital, noted, “[…] we are interested in the long term — and that’s iconic copyrights with strong cash flow profiles that can be materially grown over time.”

Warner, which has previously acquired the catalogues of David Bowie and David Guetta, is controlled by Sir Leonard Blavatnik’s Access Industries. Its stock is down 13% this year.

No official comment has been issued yet by the Red Hot Chili Peppers’ representatives.

Source: Financial Times

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.

Can`t stop reading? Read more.