More than two decades of overseas takeovers, many of them by predatory, private equity firms, has hollowed out the UK’s command and control of its own economy.

Decisions about great swathes of industrial infrastructure from ports, airports and power production to water, steel and aerospace are made not in the national interest but on behalf of financially driven investors in far-off places.

No part of the economy has been unaffected and in the pandemic the private equity firms have been buying key companies in the UK.

Among those are the world’s largest security company G4S, employing 533,000 people across the globe, and infrastructure champion John Laing, which managed the construction of the second Severn crossing, the Prince of Wales Bridge.

There has also been private equity interest in the UK’s depleted aerospace and engineering sector at engineer Senior and Ultra Electronics.

Subscribe to our Newsletter to increase your edge. Don’t worry about the news anymore, through our newsletter you’ll receive weekly access to what is happening. Join 120,000 other PE professionals today.

Investors with private equity models have been allowed to make huge inroads. Four years of Brexit uncertainty, when the eyes of the political class were elsewhere, drove down valuations for many quoted firms on the London stock market. It has been open season for predators looking for bargains.

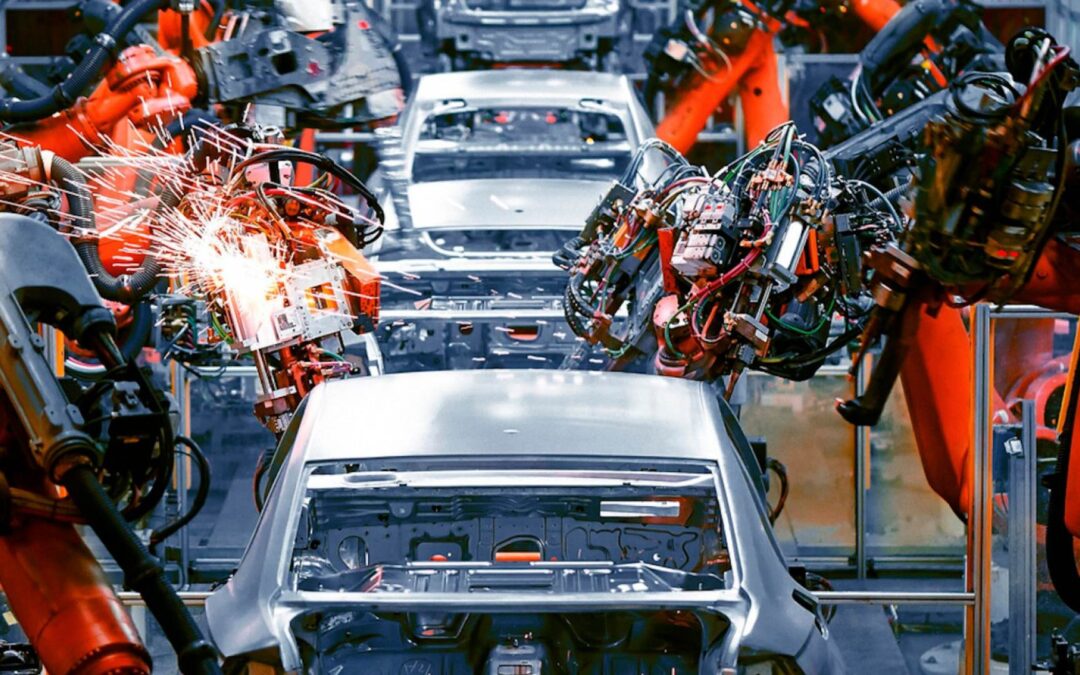

Aerospace is a depressing example – one of the sectors where Britain with its tremendous innovative history has punched above its weight.

In some cases the giants at the core of the sector – defence manufacturer BAE Systems, home of the Tornado and Typhoon fighters; and Rolls-Royce, maker of the world’s most sought-after aero engines – are guarded from takeover by a ‘golden share’ held by the Government.

But we have seen the rest of the sector decimated. UK-quoted engineer Melrose, which boasts a private equity model including extraordinary financial rewards for its founders, bought GKN – which made cannonballs used in the Napoleonic Wars and the Spitfire in the Second World War – for £8billion in 2018.

Mayfair-based Melrose shut GKN’s Midland HQ and in 2019 axed the Kings Norton factory. It closed with the loss of 170 jobs over a two-year period.

Dorset innovator Cobham was bought in 2020 by Boston private equity outfit Advent which has been busy dismantling the world’s leading maker of flight refuelling equipment ever since. Some £2.7billion of assets have been sold and vital UK tech lost.

In 2019, communications satellite maker Inmarsat was sold to private equity firms Apax and Warburg Pincus for £2.6billion.

The sales of Cobham and Inmarsat fatally denuded UK space expertise as the UK looked to withdraw from Europe’s Galileo platform, leaving the Government scrambling for alternatives.

In March this year private jet facilities group Signature Aviation was the subject of a break-up bid by three private equity firms, one controlled by Microsoft founder Bill Gates.

Another critical aerospace firm, Meggitt, which makes components for civilian and fighter aircraft, is being sized up by a debt-fuelled US competitor.

As a result, the UK’s supply lines have been eroded and valuable avionics and space-age research and development diverted away into less safe hands. The threat to national security has been palpable yet most of these transactions were nodded through.

During the pandemic predators have taken advantage of corporate weakness. G4S is hardly the UK’s most popular firm yet it is the world’s largest security and surveillance firm and guards nuclear facilities and runs prisons. It was sold to US private-equity-backed Allied Universal for £3.8billion.

The narrative behind most of these calamitous deals, which also has seen leading chip maker Arm and famous engineers such as Laird and Aggreko fall into overseas hands, is similar. Funded with debt, assets are bought at low prices and flipped to new buyers swiftly.

The buyers are aided by feeble directors because deals trigger big payouts. Melrose chief Simon Peckham and senior colleagues could reap tens if not hundreds of millions in bonuses if their ‘buy, improve and sell’ private equity model produces super-returns from the dismemberment of GKN.

Melrose is transparent, as a quoted company with a private equity model, so every move is properly and fully disclosed and accounted for. That is far from the case in most private equity deals – where owners operating behind closed doors escape opprobrium for their actions.

Source: This is Money

Can’t stop reading? Read more

EQT leads $5.5bn Galderma share sale in record Swiss secondary exit

EQT leads $5.5bn Galderma share sale in record Swiss secondary exit EQT and its co-investors have...

CVC reports record performance as €205bn private markets platform expands

CVC reports record performance as €205bn private markets platform expands CVC Capital Partners...

Brookfield explores $1.3bn acquisition of EQT and PAI-backed World Freight Company

Brookfield explores $1.3bn acquisition of EQT and PAI-backed World Freight Company Brookfield...