Busy Sydney fund manager Centennial Property Group is tapping into the commercial real estate zeitgeist, putting together a $650m vehicle, backed by private equity giant KKR, that will develop up and hold warehouse and logistics sites.

The past two years of the pandemic, and the accompanying surge in e-commerce, has turned the once-staid asset class of industrial property into the sector’s ‘new black’. Yields from industrial real estate are now sharper than the best city office towers and the boom shows no sign of slowing.

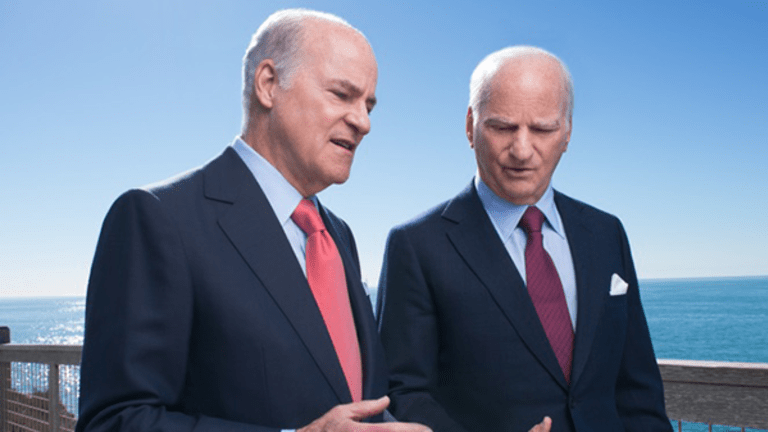

That leaves a quandary for investors: how to get set in logistics without paying over the odds for the popular property category. Centennial, founded more than a decade ago by Jonathan Wolf and Lyle Hammerschlag, have found a potential solution.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

Their new fund Build 2 Core (B2C) Partnership Fund is already scouring the nation for vacant or underutilised industrial sites that it will then develop, creating institutional-grade multi-asset estates which it will hold in the fund.

So far, four seed assets have already been secured for a little over $81 million, according to an information memorandum obtained by Street Talk. In line with the fund’s upscaling strategy, when those properties are developed and completed they will be worth more than $204 million.

Big Backers

The KKR crew are on board with the story, joining in with commitments from principals and other global investment partners who have so far contributed $245 million in equity. The fund is aiming to raise $295 million in equity to back the roll-out of what will become a $650 million fund.

Having raised the bulk of the equity with big-hitters such as KKR, Centennial has opened the book for private clients to cover the last $50 million in equity, according to an information memorandum obtained by Street Talk.

Getting into the nitty-gritty of the offer, Centennial is expecting to bring home an IRR of 13 to 14 per cent annually over the life of the fund. The fund manager is targeting distributions of 5 per cent or more each year after the fund is stabilised, from its third anniversary onwards.

Since 2011, KKR Real Estate has deployed about $US28 billion into real estate assets and real estate-related businesses.

Source: AFR

Can’t stop reading? Read more

Oscar-winning Lion Forge secures $30m from HarbourView to expand IP portfolio

Oscar-winning Lion Forge secures $30m from HarbourView to expand IP portfolio HarbourView Equity...

Klarna set to price IPO above range as demand surges for $1.27bn listing

Klarna set to price IPO above range as demand surges for $1.27bn listing Klarna is preparing to...

Dragon’s Den star Touker Suleyman bids to rescue Claire’s UK stores

Dragon’s Den star Touker Suleyman bids to rescue Claire’s UK stores Touker Suleyman, investor and...