Carlyle Group, one of the original private-equity powerhouses, has had a rocky stretch as a public company.

The Washington, D.C., firm’s shares have significantly underperformed since its 2012 initial public offering. Though they have more than tripled over the period, based on a metric that takes dividends into account, the S&P 500 is up nearly fourfold. Meanwhile, shares of Blackstone Group Inc. are up more than 11 times, Apollo Global Management Inc. —more than nine times, and KKR & Co.—more than six times.

Carlyle’s stock has been held back by the company’s stumbles in its hedge-fund and other businesses, prompting it to exit them. Carlyle also focused on generating fees tied to investment performance, rather than on management fees, which are more highly prized by public investors for their steadiness and predictability.

Its main rivals have raised more money than Carlyle, which was once known for its fundraising prowess and now manages about $250 billion.

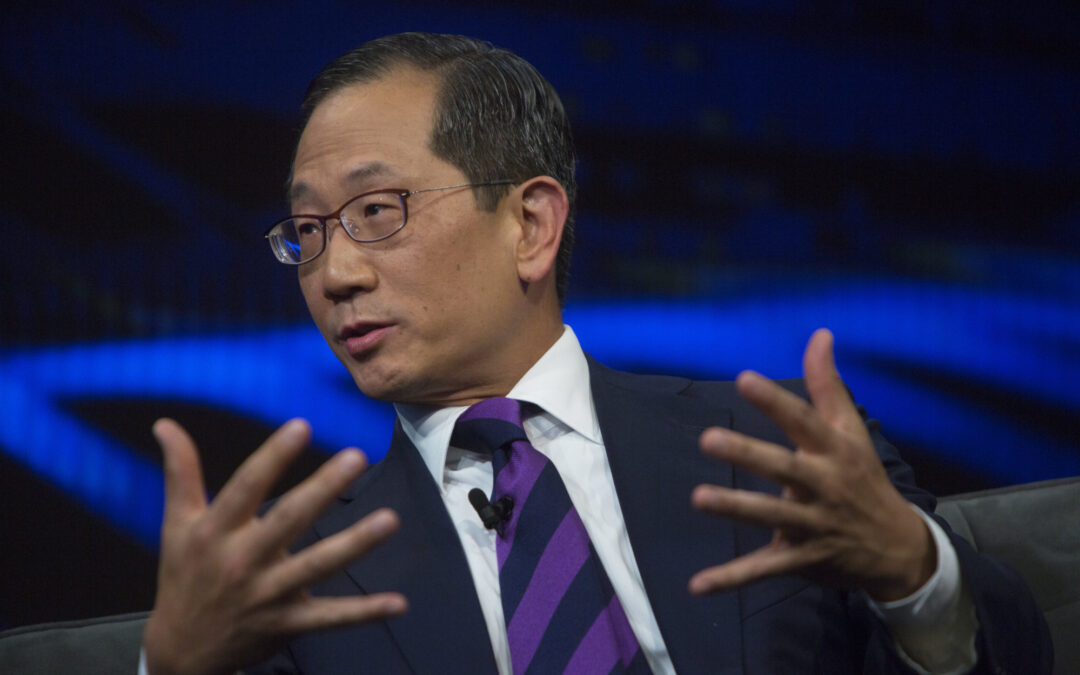

Chief Executive Kewsong Lee, 55 years old, has made it his mission to clean up Carlyle’s problem areas and close the gap with competitors. The Albany, N.Y., native became the firm’s co-CEO in 2018 and its sole chief last year.

Source: Wall Street Journal

Can’t stop reading? Read more

Carlyle and Goldman Sachs open private credit funds to Willow users with $10,000 minimum

Carlyle and Goldman Sachs open private credit funds to Willow users with $10,000 minimum Carlyle,...

EQT, PAI, and Stone Point shortlisted for €2bn takeover of Castik-backed Global Group

EQT, PAI, and Stone Point shortlisted for €2bn takeover of Castik-backed Global Group EQT, PAI...

CAIS Advisors unveils retail vehicle giving investors a stake in elite sports and media

CAIS Advisors unveils retail vehicle giving investors a stake in elite sports and media Eldridge...