Dancing Queen meets Deal King: Pophouse closes inaugural €1.2bn fundraise with support from co-investment vehicles

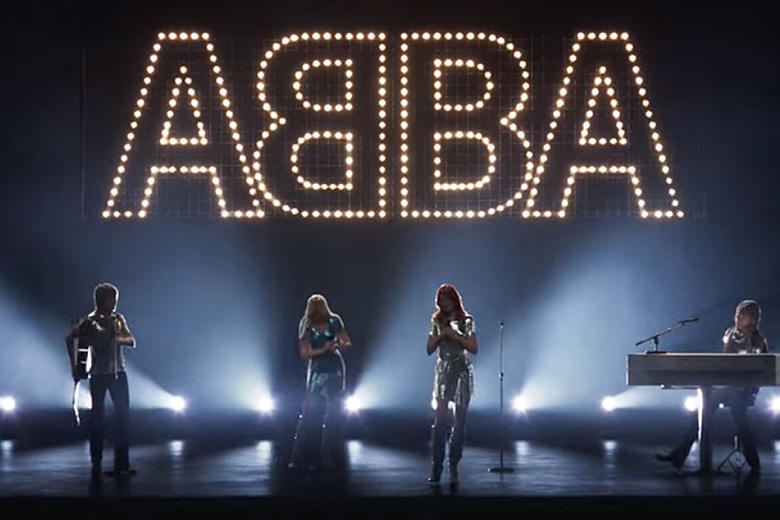

Pophouse Entertainment, the music and entertainment investment firm co-founded by EQT’s Conni Jonsson and ABBA’s Björn Ulvaeus, has closed its inaugural fundraising at €1.2bn, reaching its hard cap.

The raise ranks among the largest first-time private equity fund closings in Europe in the past decade.

Alongside the €1bn core fund, Pophouse has secured an additional €200m in co-investment capital, giving select investors the opportunity to participate directly in high-profile deals, according to sources familiar with the matter.

Led by CEO Per Sundin—former Universal Music executive and early backer of Avicii—Pophouse has already deployed around 30% of the fund. Recent landmark partnerships include deals with global artists such as KISS, Cyndi Lauper, Avicii, and Swedish House Mafia.

Pophouse’s investment strategy centres on acquiring and integrating publishing, recording, and NIL (name, image, and likeness) rights to consolidate ownership of iconic music IP. This artist-first model aims to preserve legacies while generating value for both creatives and investors.

The firm is chaired by Lennart Blecher, EQT’s Head of Real Assets, who brings deep expertise to guide Pophouse through its next phase of growth.

Amid accelerating demand for music rights and the rise of global streaming platforms, Pophouse offers investors uncorrelated exposure to a high-growth asset class. The fund has attracted a strong institutional LP base that includes pension funds, endowments, sovereign wealth funds, family offices, and high-net-worth individuals.

If you think we missed any important news, please do not hesitate to contact us at news@pe-insights.com.