A carve-out, also known as a separation, is normally used to refer to the result of the sale (divestment) of a part of a business; however, it may also be used when referring to the permanent division of an organisation into two or smaller parts without any sale, or in preparation for a future sale or initial public offering (IPO).

The complexity and timeline of a carve-out project depends largely on the level of integration of the target (the business being carved out) into the seller organisation. For example, the carve-out of an established global product line from a larger portfolio managed together with centralised support functions and systems is likely to be far more difficult to carve out than a recently acquired one-country bolt-on business that is integrated only for the purpose of financial and management reporting.

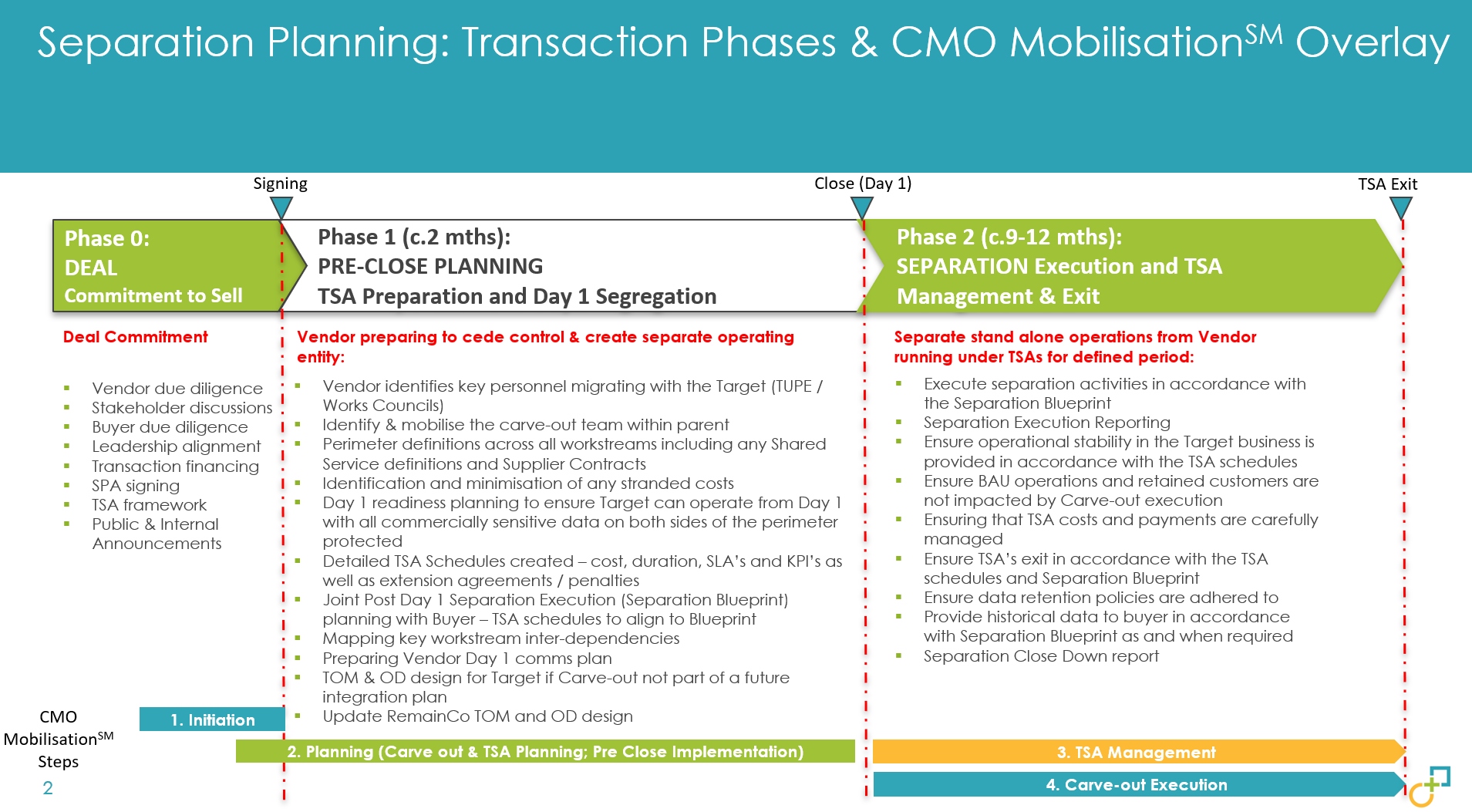

Carve-out management is an end-to-end process as depicted in Figure 1. It incorporates every activity from defining the divestiture strategy, selecting and preparing the asset for sale, and going through the motions of setting it up and dealing with the post-close clean-up after the asset has been sold.

A carve-out on the part of the seller is simultaneously accompanied by either the standing-up of a new business (pre or post close), for example, from a private equity buyer, or more commonly the integration of the sold entity (the target) into the acquirer.

Key variables likely to impact the value drivers and challenges of the separation include:

- Deal rationale for the sale: financial resources required for another purpose, nonprofitable business area, noncore product or service, management focus, regulatory mandate, geographic retraction

- Deal rationale for the acquisition: strategic growth, cost synergies, defensive position, geographic expansion, bolt-on business, future M&A strategy

- Business type of acquirer: corporate competitor, diversified conglomerate, financial investor (e.g., private equity, pension fund), management buyout, IPO

- Strategic buyers will focus on understanding commercial and operational data, including property, product development, price policy and customer relationships

- Financial buyers are also likely to focus on the restructuring and reorganisation potential or the stand-alone capability, to be able to exit ownership within 5-8 years

- Market announcements and expectations of the deal

- Scope of the business impacted; cross-border or multilanguage; cultural differences

- In-house M&A carve out capabilities of the buyer, seller, and target

-

- Stand-alone business: no integration

- Autonomous business division: minimal integration

- Integrated into acquirer: full integration

Planning a Carve-Out

Some strategic divestitures are planned a long time in advance and the management team starts to prepare the business by carving it out operationally and functionally. This may follow a market announcement about strategic direction or may just be internal preparation. Carving out the target prior to the sale may simplify the sale and separation in that the seller can hand over operational control of the business at the agreed close date without having ongoing obligations to service the business via transition service agreements (TSAs). However, since the carve-out will have to be setup as a stand-alone business, which itself may be less efficient than carving-out for an integration because the processes and systems may reflect the larger seller organisation’s own and be too heavy for the target. As a stand-alone business, there are likely to be zero or negative operating synergies.

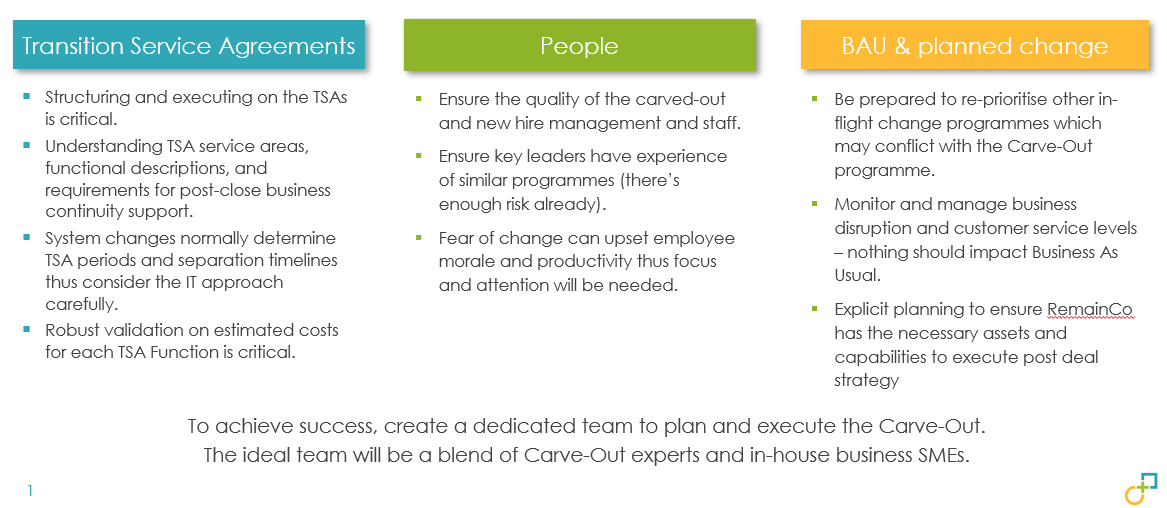

For most deals, the carve-out is announced internally at the same time as the deal is signed and announced publicly, so detailed carve-out planning can only fully start at this point with detailed separation preparation by functionally aligned resources. In this planning phase, the carve-out plans are created, and the transition services (TSAs and/or Reverse TSAs) are defined and agreed upon between the buyer and seller in the TSA Schedules.

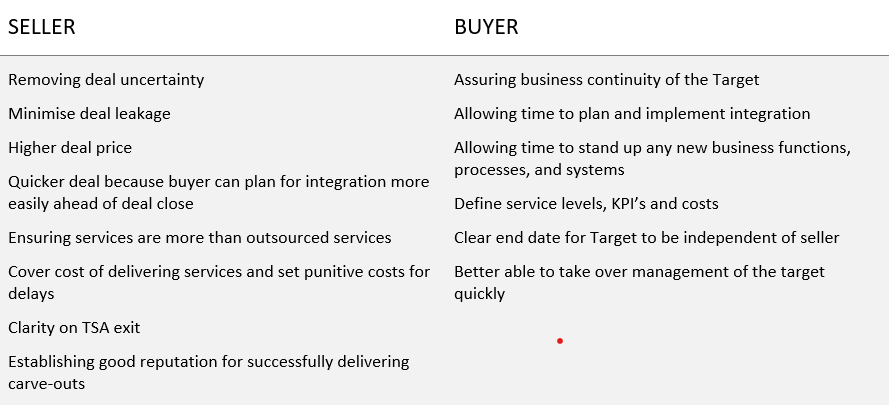

A TSA is a contract between the seller and the buyer that covers post-deal support for the target to continue operating until such time as it can be set up independently or integrated into the acquirer. They are common practice during divestitures and negotiated and signed prior to the sale and purchase agreement (SPA), or occasionally prior to the deal close if the TSA is complex. The approximate timing and the approach for TSA exit should all be planned at the time the TSAs are drawn.

Even when a buyer has performed due diligence on the target business, it is likely to still be dependent upon the seller to provide detailed accurate information surrounding the TSA scope and breakdown and a view on the costs of the business units and internal recharges. Where gaps and omissions are identified later, it is in the interest of both parties to find agreeable solutions by providing additional services if necessary.

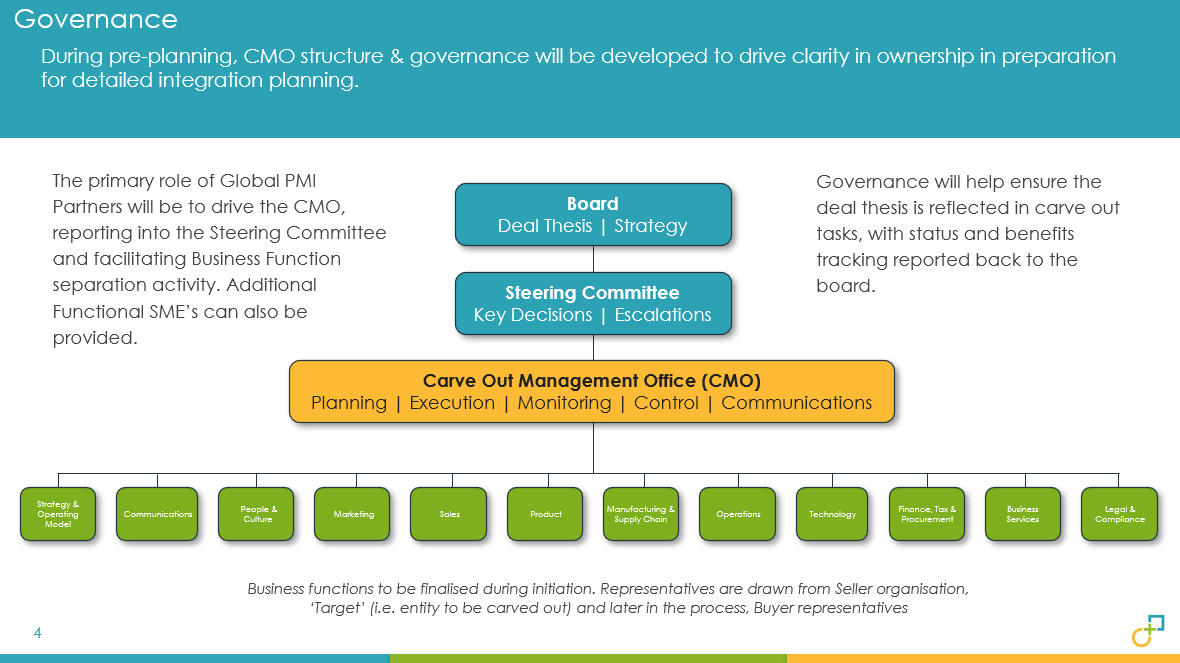

There are likely to be three distinct functional teams:

- The seller team represent the interests of the seller to ensure that the organisation (RemainCo) is not impacted by the carve-out, continues to operate and grow, that the carve-out is achieved as quickly as possible, and that the integrity of the seller-s data and systems is not compromised in any way.

- The target team, initially still reporting through the seller business, represents the interests of the target itself. Throughout the carve-out planning and TSA negotiations, the functional leads of the target ensure that the target business can operate effectively and that the TSAs are comprehensive. It is in the interest of the seller to set up a semiautonomous team to represent the target itself to demonstrate to the buyer that this independent functional team concurs with the TSAs and carve-out plans, and to provide continuity for the project throughout the carve-out and integration phases.

- The buyer team represent the acquiring organisation and focus on the integration planning.

Carve-Out: Fundamentals – building blocks for effective separation

Transaction perimeter – definition

- Defining scope of the transaction/deal both from business and legal entity structure perspective is critical

- Clarity on deal value proposition chain: product portfolio and its associated assets; operations footprint and logistics/distribution networks

- Balance creation of attractive carve-out with preserving assets, capabilities, and growth potential of RemainCo (Seller)

Day One requirements

- Defining these early is important to ensure maximum available time to prepare for effective Day 1

- For example, in an asset deal, the buyer may need to sign new employment contracts; or in a FMCG carve-out, they may need to have EDI interfaces to the trade ready

- Building a Day 1 run-book is also important and this should cover data migration, transfer of processes, customer, financial responsibilities, etc

Exit Strategy and Buyer selection

- Determining the exit strategy (Sale vs. Spin-Off/Split-Off) helps attract the right buyer to maximise sale price and may also help to minimise TSA durations

- Scenario planning for corporate buyer vs. private equity vs. consortium-led JV’s vs IPO to be considered

Perceived value proposition (Improving attractiveness to buyer)

- Reduced complexity in business operating model can inform potential integration strategies (functional vs. structural)

- Approach to sale: ‘Lift & Shift” typically requires 6-9 months vs. “Redesign” approach which requires 9-18 months;

- TSA orchestration on RemainCo. (Parent) vs. NewCo (Standalone): TSA’s can either enhance/reduce value from a buyer’s perspective

Financial Readiness

- Financial due diligence to factor indicative valuation (pricing); stranded cost analysis; group recharge model and standalone cost base

- Tax due diligence to highlight requirements on GAAP vs IFRS

Organisational Readiness

- Separation blueprint to be designed across core areas such as people, process, physical assets, technology landscape and third-party contracts to preserve RemainCo value and agility

- Ensure RemainCo People know “what does this mean for my job?”

- Separation programme office (CMO) set-up and governance is critical to the success of the transaction

- Effective communications planning and execution to all stakeholder groups

External Factors (including Regulation)

Regulatory, Unions, and Workers Councils

Carve-Out: People

For most businesses, the most important resource is talent – the experience, expertise, and creativity of the people who run it. All M&A projects can be challenging as they often put people through a tough time, both personally and professionally, so taking people matters seriously really helps to mitigate risks.

The mechanism by which staff can be identified, consulted with, and transferred is subject to local employment law regulations, which vary greatly between regions. Broadly, North American and Asia Pacific regulations tend to favour employer’s rights more than European countries, which champion employee rights. Usually, only staff who support the target business 100% (or at least, significantly greater than 50%) are transferred with the carve-out, and all others remain with the seller. Shared service functions within the seller organisation typically will not transfer any people, and the TSA period is used to recruit and build a new team or switch over to the acquirer’s corporate services. Clarity of the target team perimeter is essential as is ensuring clarity of communications to staff within the perimeter to minimise churn, as to maintain stability of those who will stay with RemainCo.

As with an acquisition, leadership and organisation announcements are important immediately after close to ensure that governance is clear. If the acquirer wants to make new leadership announcements, then these should be planned, coordinated with a settlement, or swapping out of existing management, and announced as early as it is appropriate to do so.

Carve-Out: Processes

Careful and complete process definition is important during carve-outs, especially for the buyer. It is usual to conduct a top-down business function / process analysis to identify as-is and end-state processes, which can both identify TSA requirements, but also likely level of stand-alone capability and/or integration effort likely to be required by the buyer. The buyer would need to do this in Buyer DD and the vendor can do this pre-sale in Vendor DD to enable buyers to clearly understand transaction complexity.

It is important to get the right level of detail. For example, in GPMIP’s carve-out methodology, our template for conducting business function / process area analyses starts with 12 business functions and 80 process areas, and there is often no need to go to a lower level of detail, unless the carve-out is highly complex.

Once as-is processes are understood and documented, end-state processes need to be agreed upon. For the seller producing a process blueprint, the end-state will mean the retained business operating without the carve-out. For the buyer, this means the acquired business, either stand-alone or integrated into its own business.

Such a blueprint will usually stop short of getting into the specifics about the timeline or activities required to transition to the end-state, but it can contain contextual information, for example, decision rationale, synergy and operating cost implications of process changes, and TSA dependencies. When approved, blueprints can be translated into project charters and detailed integration plans that build out the details of the transition of these processes during and after the TSA phases. Cutover of some processes can continue early, but typically many process changes will be done just before or at TSA exit.

Carve-Out: Technology

Technology infrastructure and systems are usually on the critical path when it comes to the carve-out timeline. However, it is important that decisions are people and process-led, though technology can often influence end-state process decisions. A useful start point is to draw up the technology perimeter of the transaction, ensuring the application landscape is clear, including a list of licenses included versus those that the buyer will need to have.

Recognising that a seller’s existing systems may be inappropriate for a new smaller carve-out is just as important as using the carve-out as an opportunity to move away from old or inappropriate systems. Any new systems must be planned carefully, as the volume, complexity, and cost of change in a carve-out needs to be managed.

Critical line of business technology systems, required for the operation of the business but which are shared with the parent, may need to be segregated pre-close through a logical segregation approach and creating either a new instance of a technology/application using a clone-and-go approach with the parent data removed pre-day one from the new instance or through limiting access to critical data or systems for target users through access controls.

Alternative approaches are to move straight to the acquirer’s systems by migrating data, to acquire a new fit-for-purpose system for the carved-out business, or to stop using a system if a process is simple enough and finding a manual workaround. Caution should obviously be taken before committing to a migration to a new system, and data migrations between systems managed by different companies within a short time can be a cause of significant system and operational issues. Accurate data migrations are critical to success and can be inherently more risky than typical new system go-lives, and any delays can have implications for TSA exit timelines as the TSB bank found out – an error that cost them over £180m and took the new parent in to the red.

Carve-Out: Post-Deal Transformation (for the Buyer)

‘Mission accomplished’ is usually announced at the final TSA exit, sometimes before, but there is often much more work to do before the carve-out is really running in business-as-usual mode. The TSA period normally only allows for necessary process and system changes, may have left several cloned systems that were intended as interim stages only, and processes that are heavy because they were suited to a much larger organisation or a different operating model. A second phase of change activity can therefore be scheduled after TSA exit, typically a transformation phase, which is designed to optimise the now independent business, or to enable integration into the buyer.

Global PMI Partners have a team of 300+ seasoned and expert M&A practitioners who can help you design, plan and deliver separation, divestment and carve-out projects; as well as support you with operational diligence, planning and execution activity when considering the acquisition and integration of a carve-out. We have supported clients on over 1000 transaction globally and if you find yourself in this position, we would be delighted to have an initial call with you to discuss how we help you. Learn more about Global PMI Partners here. We also interviewed PMI partners on post-merger integrations, watch this interview here.

You can also download our most recent Survey Report, ‘The Art of Successfully Delivering M&A Value’ here. The report looks at each stage of the deal lifecycle, drawing on the wealth of M&A experience of respondents from all industry sectors and business functions, M&A roles, levels of seniority and of course geographical base. Key insights have been developed from successful M&A projects and focus on those areas deemed to be the most significant to underpin the reliable delivery of value.

About

Global PMI Partners

Global PMI Partners is a specialist consulting firm supporting private equity clients and their portfolio company executive teams with their inorganic growth strategies, M&A integrations and divestments. We provide expert, on-demand M&A services and resources, leveraging our market leading approach and methodologies. We have significant experience working with companies across all industry sectors.

We have experience of over 1,000 operational due diligence, acquisition integration, carve out and transformation projects, with a global team of over 300 seasoned professionals across EMEA, North America and APAC (130 of which are in the UK). This wealth of knowledge helps our clients achieve the desired value from acquisition and divestment strategies. Our goal is to help our clients achieve this at a faster pace, at lower overall cost and reduced risk.

As leaders in the provision and resourcing of Due Diligence, Integration and Carve Out Projects, we also offer on-demand expertise and capabilities to support you in any of your key functional workstreams, such as strategy, operating model, sales, marketing, product, technology, finance, HR, comms, supply chain, etc. All of our highly experienced team members are well used to being embedded within our clients’ teams.

In addition, we provide a range of specific M&A services tailored to the unique needs of our clients, including one-day executive workshops, health checks (ensuring your integration or divestment projects are set up for success), diagnostics (e.g. maximising value from previous acquisitions) and dedicated M&A project training programmes.

Contact us to see how we can support your M&A integration and divestment requirements.

Can’t stop reading? Read more

US Pipeline Operator ONEOK Inks Two Deals for $5.9 Billion

US pipeline operator ONEOK Inc. agreed to buy a Permian Basin rival and a controlling stake in...

Blackstone Is Said to Seek A$5.5 Billion Loan for AirTrunk Bid

Private equity firm Blackstone Inc. is in discussions with banks for a five-year loan of about...

Thrive Capital to lead multi-billion dollar OpenAI investment round at $100bn valuation

OpenAI, the company behind the popular AI tool ChatGPT, is in advanced talks to secure several...