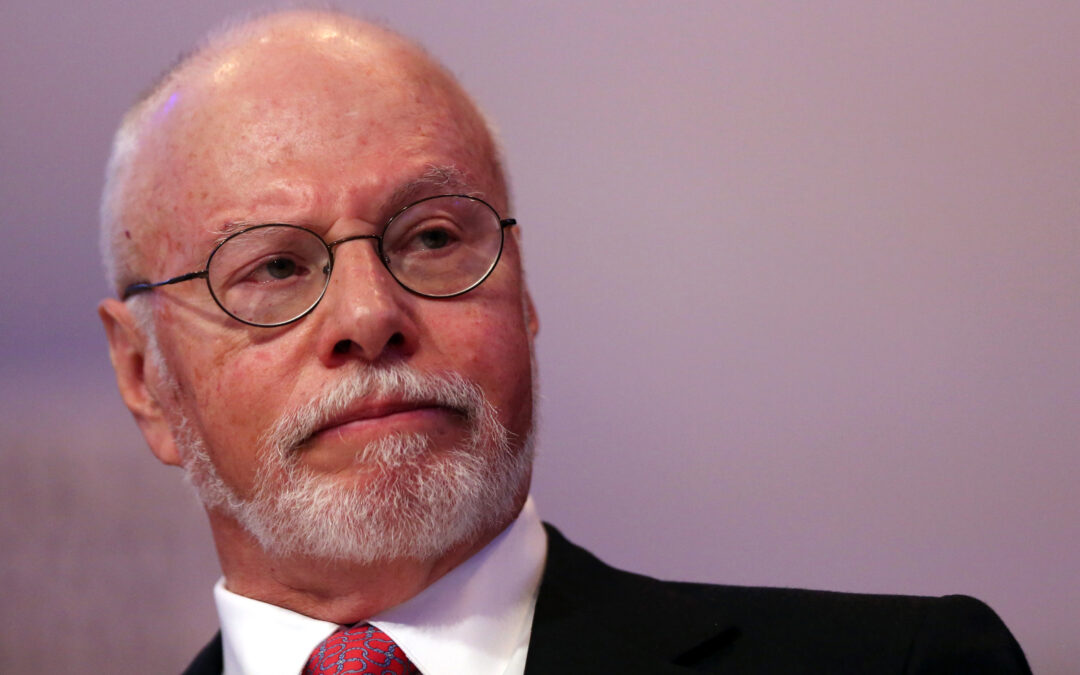

Billionaire Paul Singer’s Elliott Management Corp. is exploring a bid for Aryzta AG, the ailing Swiss baking company that makes Otis Spunkmeyer cookies, people familiar with the matter said.

The U.S. investment firm has been studying a potential offer for Aryzta, according to the people, who asked not to be identified because the information is private. Aryzta, which also supplies buns to McDonald’s, has separately been attracting interest from private equity suitors including Apollo Global Management Inc. and Cerberus Capital Management, Bloomberg News reported last month.

Canadian grocery and baking giant George Weston Ltd. has also been weighing its own bid, people with knowledge of the matter have said. Shares of Aryzta have fallen 46% this year, giving the company a market value of about 586 million Swiss francs ($648 million).

Elliott’s deliberations are at an early stage, and there’s no certainty it will proceed with a formal offer, the people said. Representatives for Elliott and Aryzta declined to comment.

Aryzta hired Rothschild & Co. this year to conduct a strategic review and said in July that several parties had expressed unsolicited interest in acquiring the company. Swiss firms have been involved in $40.3 billion of mergers and acquisitions this year, down 33% from the same period in 2019, according to data compiled by Bloomberg.

Elliott, known for activist investments where it purchases stakes in public companies and agitates for change, also has a private equity arm that buys struggling firms and fixes them up itself. Last year, it bought Barnes & Noble Inc. after previously acquiring British bookstore chain Waterstones and network-technology company Gigamon Inc.

Source: Bloomberg