Bermuda-based consolidation vehicle is the third incarnation of Sir Clive Cowdery’s acquisitive Resolution

Resolution Life, an insurance consolidation vehicle founded by Sir Clive Cowdery, has completed a $3bn fundraising and added several of the investors who contributed, including JPMorgan and KKR, to its board.

Bermuda-based Resolution Life, founded in 2017, is Cowdery’s latest vehicle for buying and merging insurers.

A previous UK company, also called Resolution, acquired a series of businesses in the 2000s before merging with Britannic Group and then being sold to Hugh Osmond’s Pearl Group, later becoming Phoenix Group.

Cowdery relaunched the Resolution business a second time, buying Friends Life in 2009 and adding other businesses from Axa Sun Life and Bupa. This was then sold to Aviva in 2014.

This latest, third incarnation has acquired $5.7bn of life insurance policies from US insurer Symetra, and in October 2018, agreed to buy various insurance businesses from AMP in Australia and New Zealand for A$3bn.

In a statement on November 18, Resolution Life said it has raised $3bn from investors to finance further deals.

Representatives from JPMorgan, KKR, the Nippon Life Insurance Company, Singaporean sovereign wealth fund Temasek, and USS, the UK’s largest pension fund, will join its board — alongside an unnamed Middle Eastern sovereign fund.

Credit Suisse Asset Management acted as a placement agent on the fundraising.

Cowdery, who is executive chair of the company, said: “Resolution Life will continue to grow and release trapped capital and stranded costs for life insurers across a number of markets. I am delighted to welcome our cornerstone investors onto our board.”

Source: Financial News

Can’t stop reading? Read more

J.F. Lehman acquires majority stake in Denmark’s Wrist Supply Services

J.F. Lehman acquires majority stake in Denmark’s Wrist Supply Services J.F. Lehman & Co. (JFLCO) acquired a majority stake in Denmark-based Wrist Supply Services, a global leader in marine supply and logistics. The private equity firm will partner with Wrist’s...

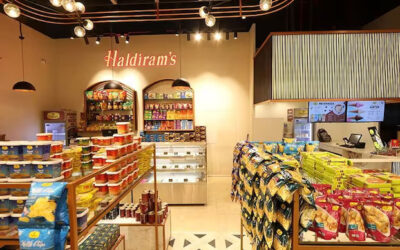

Temasek acquires 10% stake in Haldiram’s for $1bn, betting big on India’s snack market

Temasek acquires 10% stake in Haldiram’s for $1bn, betting big on India’s snack market Singapore’s state-owned investment firm Temasek secured a nearly 10% stake in Haldiram’s for $1bn, valuing the Indian snack giant at approximately $10bn. This deal marks one of the...

Maven Capital fuels Digital Rewards Group’s global growth with major investment

Maven Capital fuels Digital Rewards Group’s global growth with major investment Private equity firm Maven Capital Partners made a significant investment in Altrincham-based Digital Rewards Group (DRG), a fast-growing discounts and experiences platform. The funding...