Subscribe to our Newsletter to increase your edge. Don’t worry about the news anymore, through our newsletter you’ll receive weekly access to what is happening. Join 120,000 other PE professionals today.

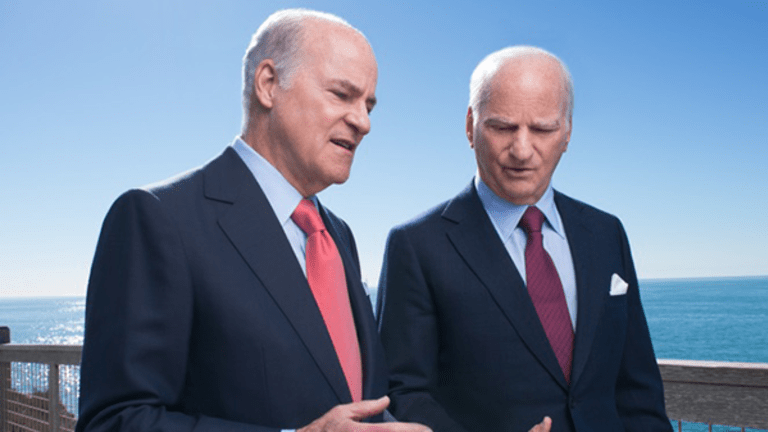

Approximately two-thirds of the bridge loans, construction financings and mortgages on stabilized properties that KKR has closed on or circled so far this year are pegged to fixed

rates, while the rest have floating rates. There’s still a heavy focus on multi-family lending, but about 15% of loan volume is tied to industrial properties and about 5% involves life-science properties. Taken together, those two sectors previously accounted for less than 5% of KKR’s commercial real estate lending activity.

“Coming out of Covid, both of those markets have been really active, that’s where we’re seeing the demand, from borrowers looking to acquire, refinance, reposition or develop commercial properties,” Salem said. “Both of those [property sectors] were growing before, but Covid accelerated the trend.”

About half of KKR’s originations and commitments so far this year came via its mortgage REIT (KKR Real Estate Finance) or its debt funds. The rest came on behalf of Global

Atlantic, whose origination volume prior to the KKR takeover couldn’t be learned.

Can’t stop reading? Read more

Private equity’s 2026 bottleneck is exits, according to Preqin data

Private equity’s 2026 bottleneck is exits, according to Preqin data Private equity is entering...

Old structures, new relevance: the quiet return of investment trusts

Old structures, new relevance: the quiet return of investment trusts Listed private equity has...

EQT Growth joins $330m Lovable round to scale AI-driven software building

EQT Growth joins $330m Lovable round to scale AI-driven software building Lovable has raised $330m...