KKR today announced the signing of a definitive agreement to invest in Charter Next Generation (“CNG”), a leading producer of specialty films used in flexible packaging, industrial, healthcare, and consumer applications.

KKR will be joining Leonard Green & Partners, L.P. as an equal co-owner of the business, and a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) will also be investing in the transaction to become a minority owner.

With more than 30% of all food produced globally wasted due to spoilage, Charter Next Generation offers solutions for keeping food fresh longer, while maintaining the lowest carbon footprint of any major packaging substrate given its optimised size and lighter weight. These attributes are imperative at a time when in the U.S., for example, 54 million Americans are food insecure, up significantly due to the COVID-19 pandemic. Additionally, with landfills being the third-largest industrial emitter of methane, food waste alone represents 8% of total global greenhouse gas emissions.

CNG manufactures high performance specialty films focused especially on the critical inner lining of packaging, protecting foods and other goods by creating heat resistance, sterility, oxygen and odor barriers, UV shields, moisture protection, and more. These specialty films also allow for recyclability, compostability, and the use of post-consumer resin. In addition, CNG’s high-performance, specialty films are used in a variety of other industrial, healthcare, and consumer applications.

“Charter Next Generation offers the gold standard when it comes to materials science, product quality, innovation, and technical expertise in specialty films,” said Josh Weisenbeck, KKR Partner who leads KKR’s Industrials investment team. “We are looking forward to investing in the company’s growth as they continue to raise the bar in innovation and sustainability.”

“Continuous investment in our film technologies and in our team is mission critical for us, which is why we are excited to partner with these exceptional, forward-thinking firms – particularly for their steadfast approach to employee engagement and ownership,” said Kathy Bolhous, CEO of Charter Next Generation. “Offering all employees ownership in the company aligns everyone around our objectives while providing financial rewards for their efforts, fitting well with our employee first culture.”

For over a decade, KKR’s Industrials team has focused on employee engagement as a key driver in building stronger businesses. The strategy’s cornerstone has been to allow all employees to take part in the benefits of ownership by granting them the opportunity to participate in the equity return alongside KKR. Beyond sharing ownership, KKR also supports employee engagement by investing in training across multiple functional areas and by partnering with the workforce to give back to the community.

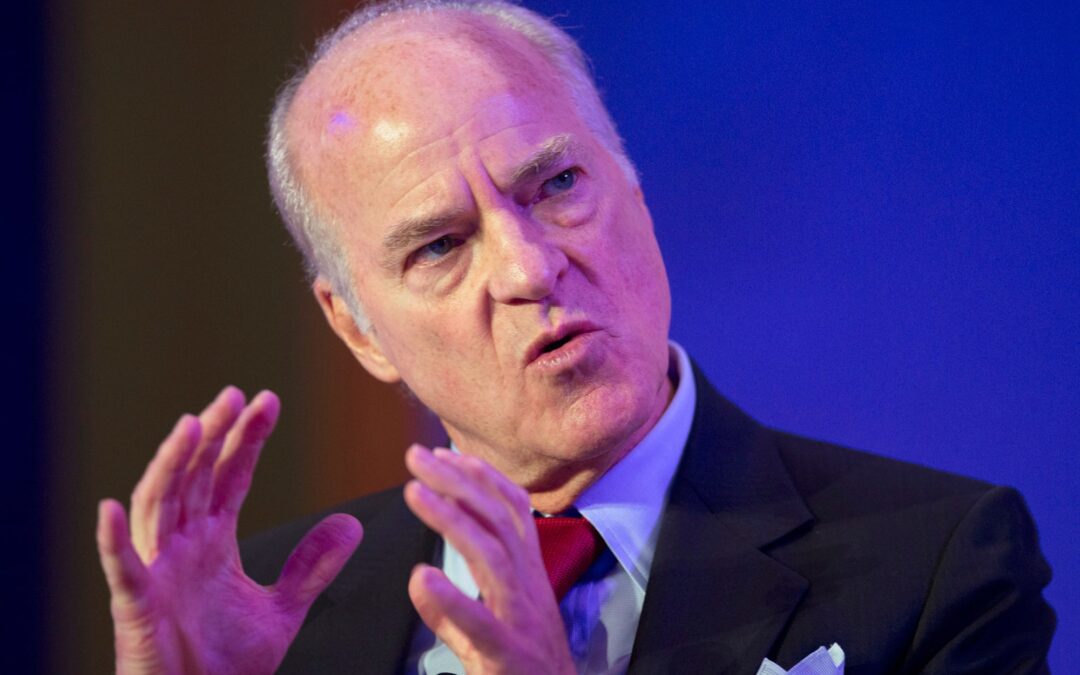

“We are thrilled to have the opportunity to invest in Charter Next Generation not only because they are an industry leader on many fronts, but also because Kathy and her team are completely aligned with how we approach building stronger manufacturing companies: by building stronger company cultures through a robust employee engagement and ownership program,” said Pete Stavros, KKR Partner and Co-Head of Americas Private Equity at KKR.

Source: Business Wire

Can’t stop reading? Read more

Luckin investor Centurium in talks over £1bn Costa Coffee takeover

Luckin investor Centurium in talks over £1bn Costa Coffee takeover Centurium Capital, the Chinese...

“Cash is king, and anything else is an opinion”: private equity’s return to fundamentals

“Cash is king, and anything else is an opinion”: private equity’s return to fundamentals After a...

Neuberger Berman closes $7.3bn private debt fund, surpassing target

Neuberger Berman closes $7.3bn private debt fund, surpassing target Neuberger Berman has announced...