Moonfare, the Berlin-based FinTech platform that provides access to Private Markets investment managers, has recently announced the addition of a new PE Buyout fund to its offering.

What is the fund’s investment strategy?

The recently launched fund has outperformed peers by investing in globally leading large and mid-cap companies since inception. The target companies focus on driving sustainable value creation within its core sectors which include healthcare and technology. The manager invests mainly in Northern Europe and the United States.

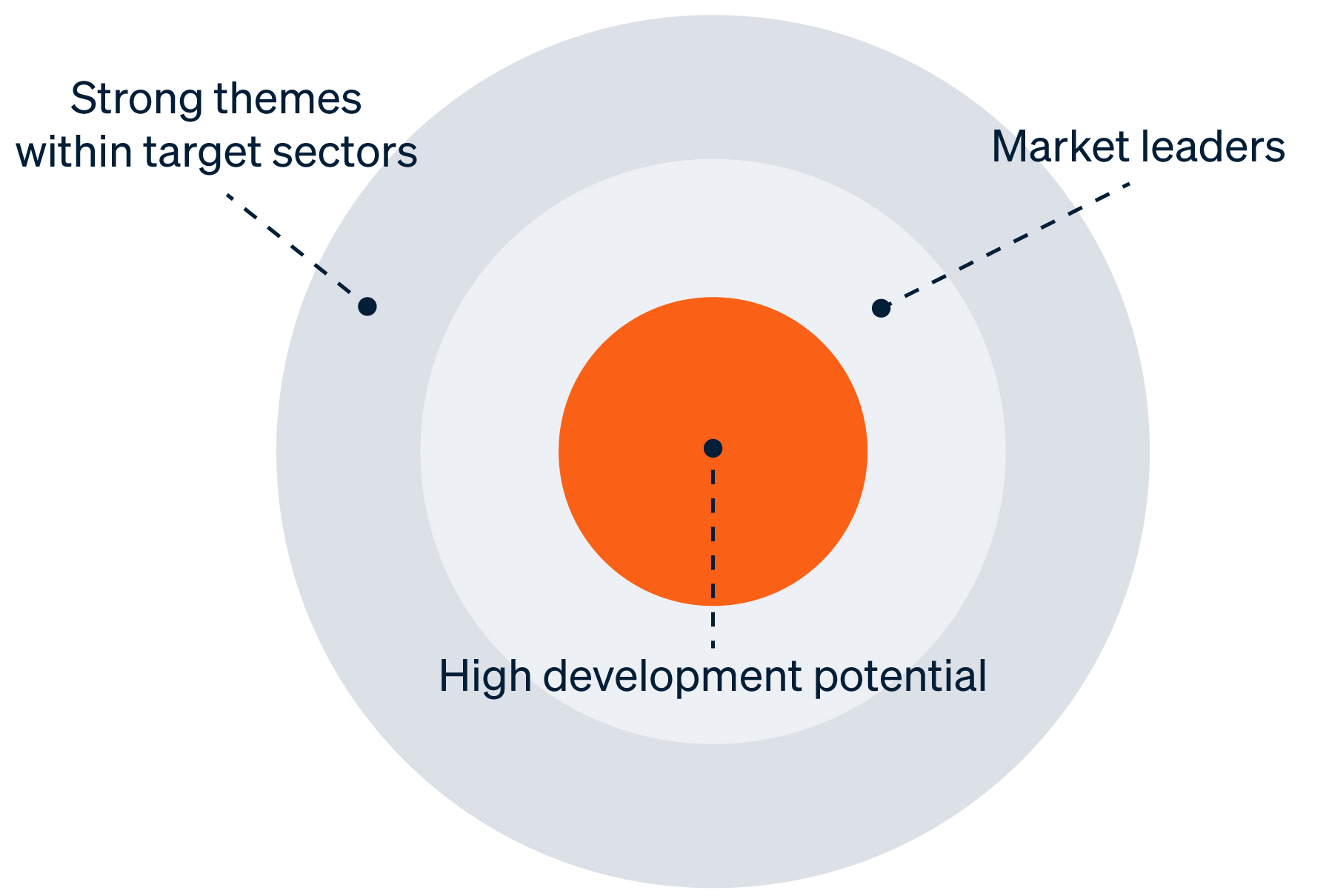

The fund employs a refined investment strategy identifying leaders within core sectors and geographies, in order to find long-term winners. It focuses on digitalization and sustainability with a systematic approach to value creation and a clear, well-established governance model. Furthermore, the manager has a structured selection process with close involvement of the Sector teams.

Growth and Transformation

Since its creation more than 25 years ago, the fund has been providing strong and consistent returns across fund vintages. The returns are largely driven by improving the operational performance of its portfolio companies leading to a consistent outperformance of over 10% against the MSCI Europe Index across market cycles.

About Moonfare

Moonfare is Europe’s premier private equity investment platform for qualified high-net-worth individuals. It uses its proprietary technology to provide access to top-tier private equity funds within minutes. Founded in 2017 by former KKR executives Dr. Steffen Pauls and Alexander Argyros, Moonfare has been built by a team of experienced professionals from leading investment and technology companies, including Apax Partners, J.P. Morgan, Amazon, Microsoft, AngelList, PitchBook and Rocket Internet.

Can’t stop reading? Read more

Blackstone books $400m-plus gain as CVC completes Marathon acquisition

Blackstone books $400m-plus gain as CVC completes Marathon acquisition Blackstone has made a gain...

Mubadala joins PE-heavy funding round for Dubai property platform

Mubadala joins PE-heavy funding round for Dubai property platform Mubadala Investment Company has...

Permira launches Neuraxpharm sale as lenders line up $1.8bn of buyout debt

Permira launches Neuraxpharm sale as lenders line up $1.8bn of buyout debt Permira has formally...