Moonfare builds first ever on-demand secondary market for individual private equity investors; Lexington Partners to bring institutional liquidity to Moonfare platform. Moonfare reduces barriers between individual investors and allocations to private equity even further

BERLIN & LONDON, January 26, 2021 — Moonfare is bringing a full-service liquidity offering to individual investors in private equity, one of the most illiquid asset classes, rewriting the rules that have defined this part of the industry and asset class for decades.

Lexington, one of the largest secondaries fund managers in the world, will participate in the Moonfare Secondary Market alongside interested Moonfare clients as a buyer of stakes in Moonfare funds. In a formal process twice per year or, subject to certain conditions, on an ongoing basis, Moonfare investors will be able to trade their fund stakes for cash.

Game changer for individual investors and the private equity industry

The exclusive agreement with Lexington and improvements to the Moonfare Secondary Market benefit every investor on Moonfare’s platform. Across all asset classes, from publicly traded stocks to classically illiquid private equity positions, increasing liquidity improves the health and efficiency of the associated markets.

“We listened to the market, and illiquidity was one of the main concerns left standing between individual investors and allocations to private equity,” says Moonfare founder and CEO Dr. Steffen Pauls. “With this agreement, Moonfare has once again delivered a game changer to the private equity industry.”

“Our agreement with Lexington also confirms our obsession with fund selection,” adds Steffen. “Demand for our carefully chosen funds forms the basis of our new partnership with Lexington and everything we do.”

“We are excited to sign this partnership with Moonfare, which will make Lexington an important liquidity provider to individual investors, an underserved portion of the market,” said Pål Ristvedt from Lexington Partners. “Moonfare’s demonstrated track record in offering high-quality private equity funds was also a key driver of this agreement.”

How the Moonfare Secondary Market works: two pathways to liquidity

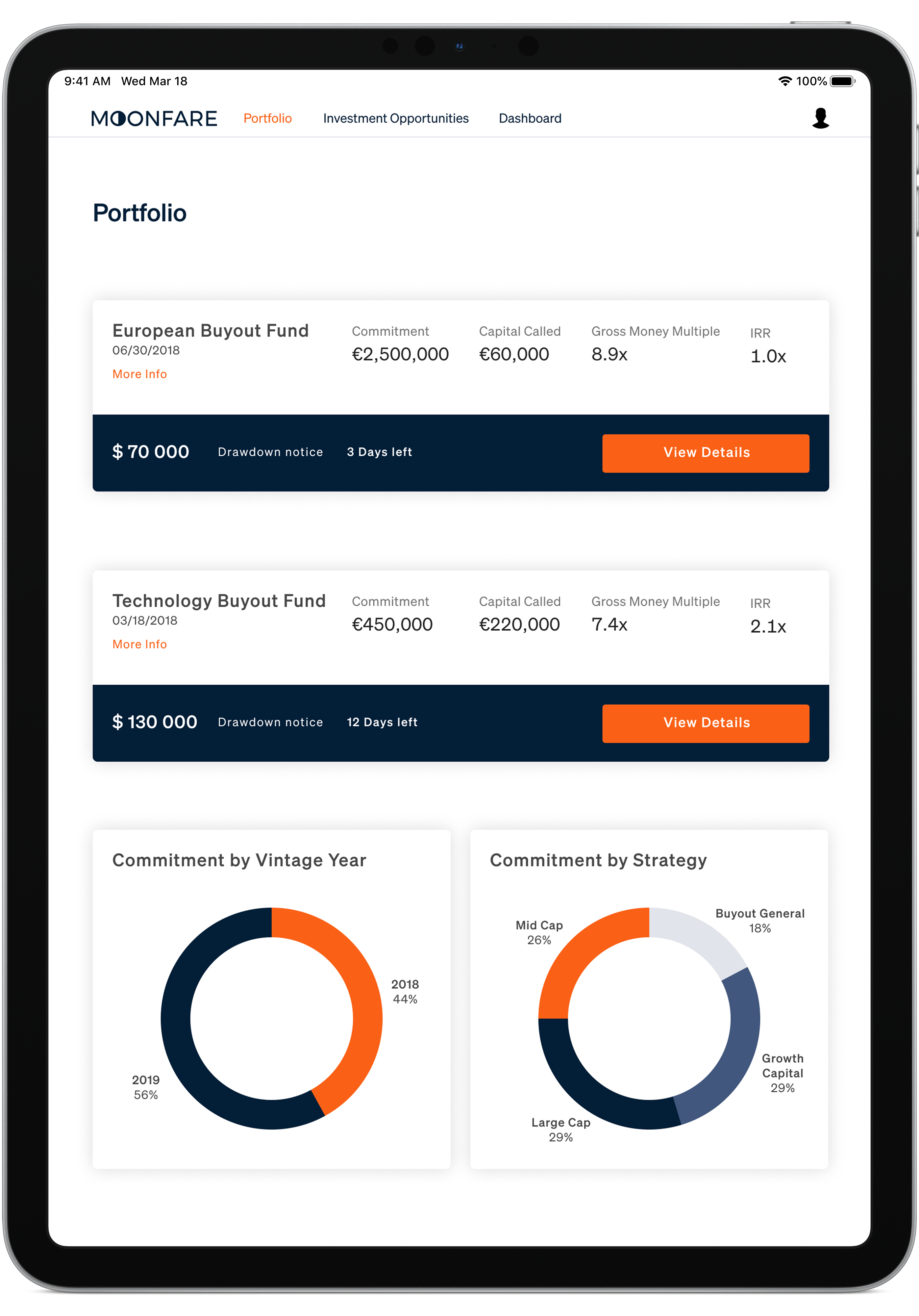

At any time, Moonfare clients can indicate interest digitally on the platform to participate as a buyer or a seller in the Moonfare Secondary Market. Twice per year, in the spring and in the fall, Moonfare will conduct a formal process to collect bids digitally and endeavor to find the best liquidity solution possible for sellers.

In the event a Moonfare investor wishes to sell his or her fund stake outside of the liquidity process, Moonfare will work with the client to prepare an offer for Lexington to review.

About Moonfare

Moonfare offers individual investors access to top private markets investment opportunities for the first time. With a technology-powered onboarding process and asset management platform, Moonfare allows clients to register and invest in the funds on its platform in as little as 15 minutes and with minimums as low as €50,000.

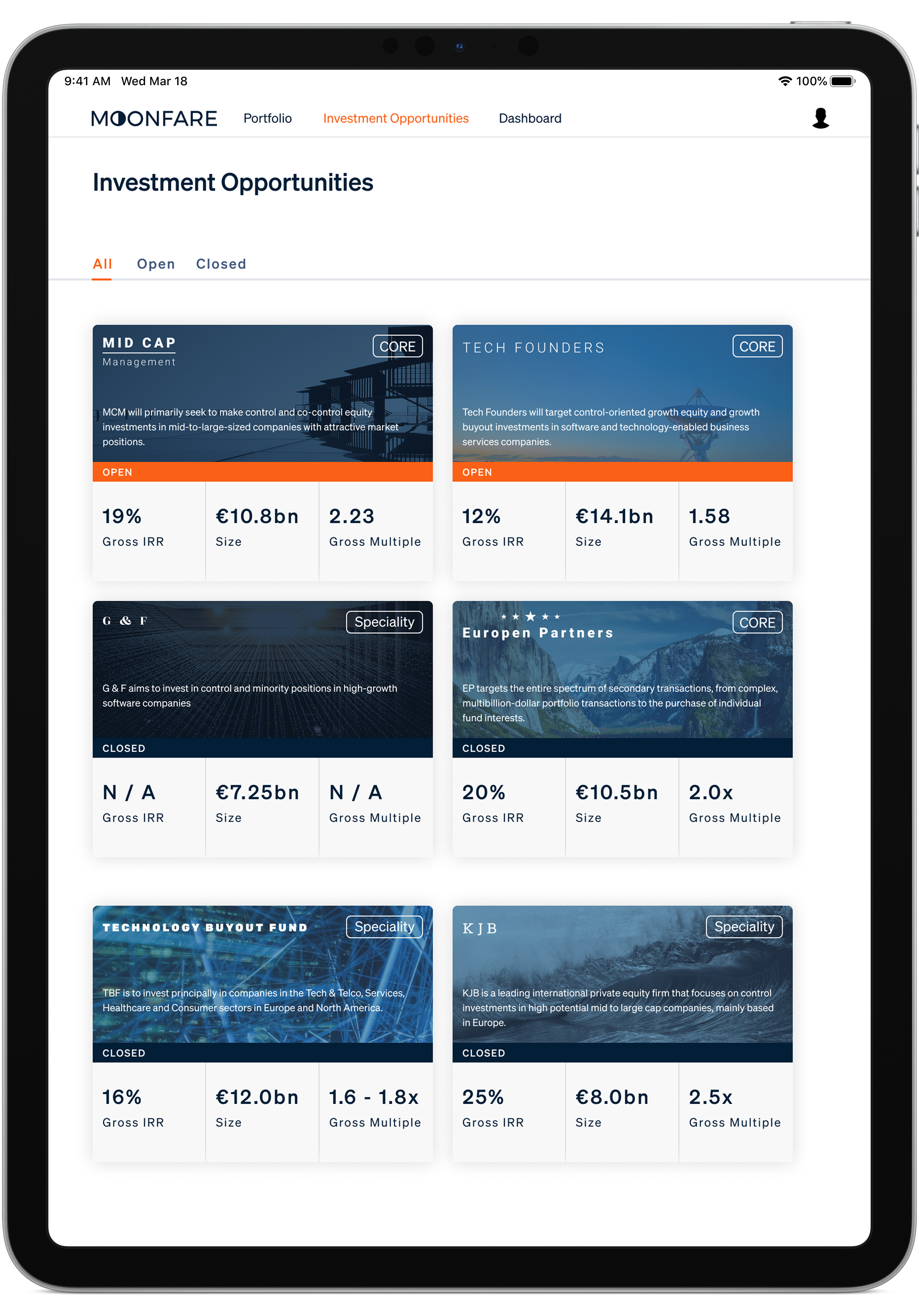

To date, Moonfare has offered more than 25 private markets funds from top general partners worldwide with an emphasis on private equity buyouts, technology and, more recently, specialised funds covering infrastructure and healthcare.

Moonfare’s investment team conducts ground-up due diligence on all funds. Fewer than 5% of available funds pass this process and make it onto Moonfare’s platform. This focus on quality is one reason Moonfare has won the trust of more than 1,000 clients who have invested more than €500 million on its platform. LinkedIn named Moonfare as one of the top 10 startups in Germany for 2020.

About Lexington Partners

Lexington Partners is one of the world’s largest and most successful independent managers of secondary private equity and co-investment funds. Since 1990, Lexington Partners has organized 20 secondary funds and 9 co-investment pools with over $52 billion in historical committed capital. Its investors include more than 1,000 leading public and corporate pension funds, sovereign wealth funds, insurance companies, financial institutions, endowments, foundations and family offices from more than 40 countries.

Lexington Partners helped pioneer the development of the institutional secondary market more than 25 years ago and created one of the first independent, discretionary co-investment programs 22 years ago.

Media Contacts

Yuri Narciss

Managing Director

+49 160 271 1531

[email protected]

Zeke Turner

+49 162 998 1165

[email protected]

Partner: Moonfare

Can’t stop reading? Read more

Blackstone secures $1bn private credit package for $2.5bn Champions Group deal

Blackstone secures $1bn private credit package for $2.5bn Champions Group deal Blackstone has...

Missoni family passes baton as FSI takes control of €130m fashion house

Missoni family passes baton as FSI takes control of €130m fashion house FSI has become the...

Silver Lake-backed TKO launches $900m loan after $150m dividend

Silver Lake-backed TKO launches $900m loan after $150m dividend TKO Group Holdings, backed by...