NFL Commissioner hails private equity’s ‘incredible success’ in US football franchise ownership

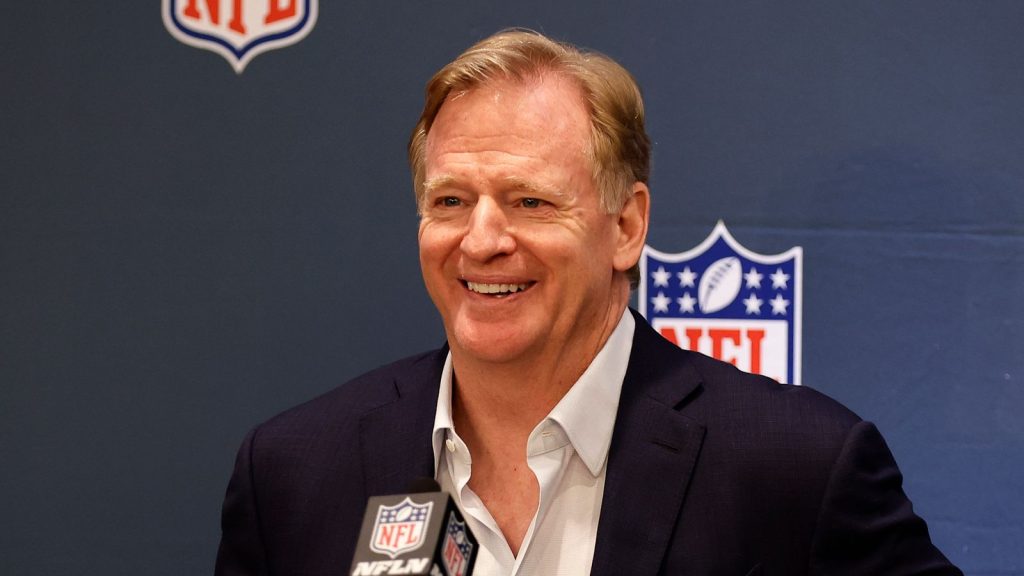

National Football League Commissioner Roger Goodell has praised the league’s decision to open its franchise ownership structure to private equity, describing the move as “incredibly successful” in attracting capital and fuelling growth, according to a report by Bloomberg.

Speaking at the USC Next Level Sports conference in Los Angeles, Goodell said private equity investment has become “a source of capital, a source of liquidity for our teams,” allowing franchises to reinvest in infrastructure and strengthen their balance sheets.

The NFL approved private equity investment last year, permitting funds to acquire up to 10% of a franchise through passive, non-voting stakes. Since then, several prominent alternative asset managers have taken positions in teams at record valuations.

Arctos Partners has acquired shares in the Buffalo Bills and Los Angeles Chargers, while Ares Management purchased part of the Miami Dolphins at an $8.1bn valuation. The Las Vegas Raiders sold 7.5% stakes each to Silver Lake Management’s Egon Durban and Discovery Land Company’s Michael Meldman. Earlier this month, Sixth Street agreed to buy 3% of the New England Patriots, valuing the franchise at more than $9bn.

All private equity investors approved under the new framework are required to hold their positions for at least six years.

The move reflects the NFL’s broader effort to modernise its ownership structure and tap into alternative capital markets, as rising franchise valuations have made full ownership increasingly difficult for individuals or families.

If you think we missed any important news, please do not hesitate to contact us at [email protected].

Can`t stop reading? Read more.