Providence Equity Partners exited its stake in Tempo Music, selling its controlling interest to Warner Music Group in a deal valued at $450m.

The transaction, which includes cash and the assumption of Tempo’s debt, marks Warner’s latest move to expand its catalog of music rights.

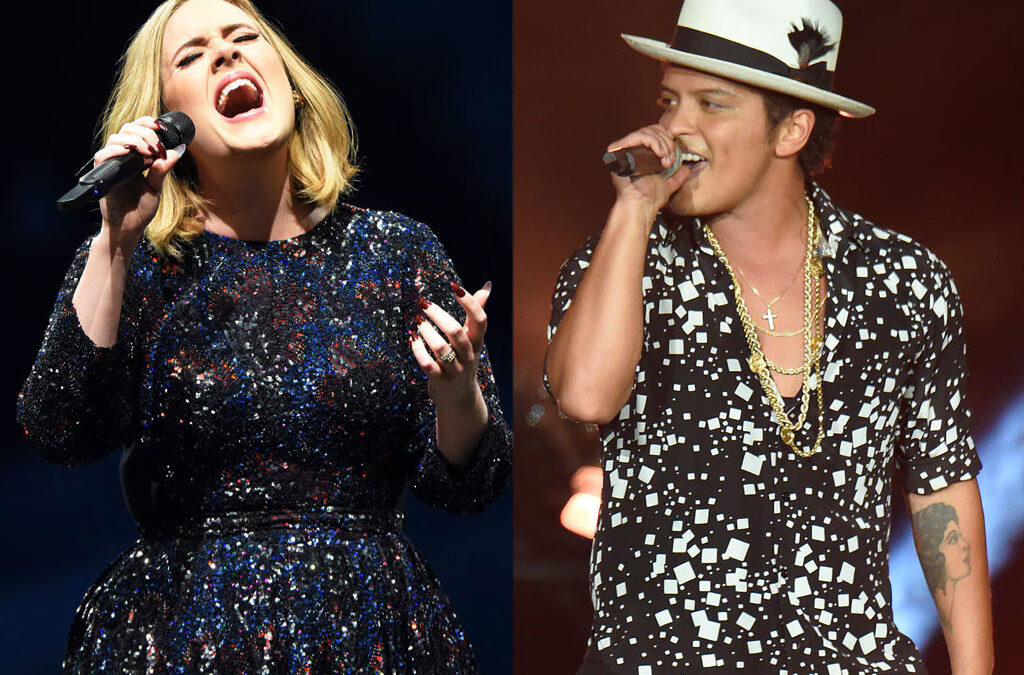

Warner originally partnered with Providence in 2019 to launch Tempo as a vehicle for acquiring music rights. Under Providence’s ownership, Tempo built a portfolio that includes rights to songs from Bruno Mars, Adele, and Wiz Khalifa. The sale aligns with a broader trend of private equity firms capitalizing on the rising value of music assets.

Guy Moot, co-chair and CEO of Warner’s publishing division, said the acquisition presents new opportunities to unlock value from Tempo’s catalog. Meanwhile, Warner joins major music companies like Sony and Universal in aggressively acquiring song rights as demand for intellectual property continues to grow.

Warner Music shares have gained 3.5% this year ahead of its upcoming earnings report, reflecting investor confidence in the long-term value of music assets.

Can’t stop reading? Read more

Clessidra enters Italian bakery sector with 70% Laurieri acquisition

Clessidra enters Italian bakery sector with 70% Laurieri acquisition Clessidra Private Equity has...

Apollo steps in with $745m financing package as Virgin Atlantic ramps up fleet investment

Apollo steps in with $745m financing package as Virgin Atlantic ramps up fleet investment...

Thoma Bravo secures shareholder approval for $12.3bn Dayforce take-private

Thoma Bravo secures shareholder approval for $12.3bn Dayforce take-private Thoma Bravo has...