Quantum computing company IonQ Inc said on Monday it will go public through a merger with a blank-check firm in a deal that gives the combined company a pro-forma market capitalisation of $2 billion.

The merger will provide IonQ with gross proceeds of $650 million, which includes a private investment of $350 million from private equity firms Silver Lake, Fidelity Management and Research, automaker Hyundai Motor Co and others.

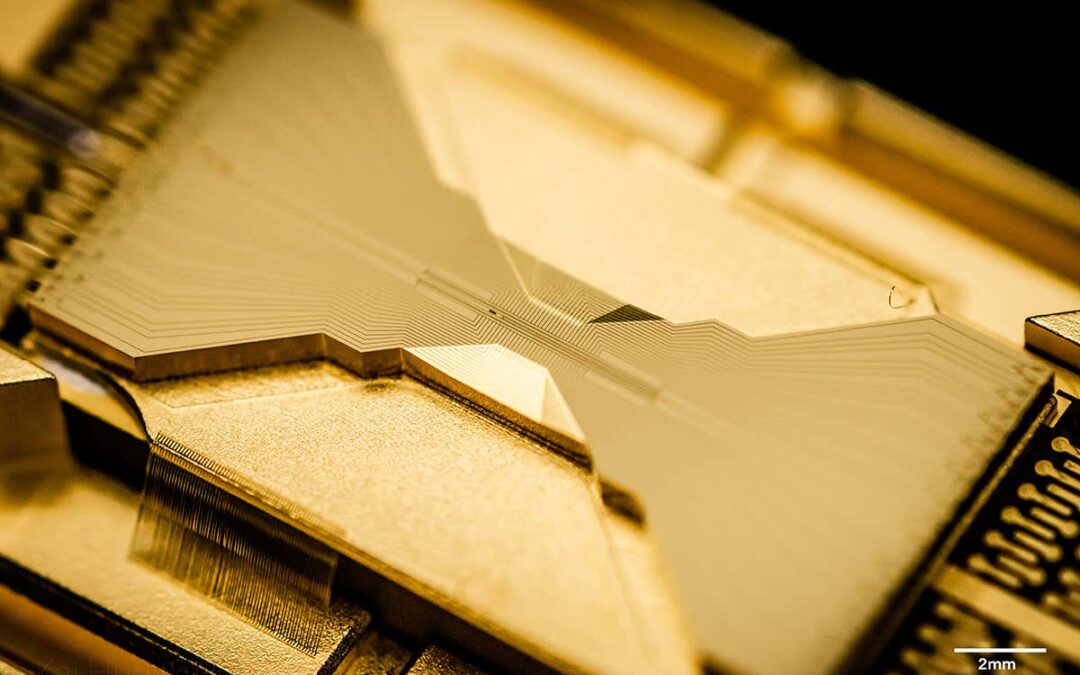

Founded in 2015, College Park, Maryland-based IonQ has partnered with Microsoft Corp and Amazon.com Inc’s Amazon Web Services (AWS) to make its quantum computers available through cloud technology, its website showed.

Other investors of IonQ include Samsung Catalyst Fund, Lockheed Martin Corp and Airbus Ventures, among others.

dMY Technology Group Inc III , a so-called special purpose acquisition company (SPAC), raised $275 million through an initial public offering in November last year.

SPACs are shell companies which raise funds through an IPO to acquire a private company, which then becomes public as a result. It serves as an alternative for companies looking to enter public markets and allows more certainty in terms of the valuation it can receive on the deal.

Source: Reuters

Can’t stop reading? Read more

Carlyle and Goldman Sachs open private credit funds to Willow users with $10,000 minimum

Carlyle and Goldman Sachs open private credit funds to Willow users with $10,000 minimum Carlyle,...

EQT, PAI, and Stone Point shortlisted for €2bn takeover of Castik-backed Global Group

EQT, PAI, and Stone Point shortlisted for €2bn takeover of Castik-backed Global Group EQT, PAI...

CAIS Advisors unveils retail vehicle giving investors a stake in elite sports and media

CAIS Advisors unveils retail vehicle giving investors a stake in elite sports and media Eldridge...