Sierra Space, a commercial space company based in Louisville, raised $1.4 billion from investors during the first round of a capital raise campaign, according to a news release.

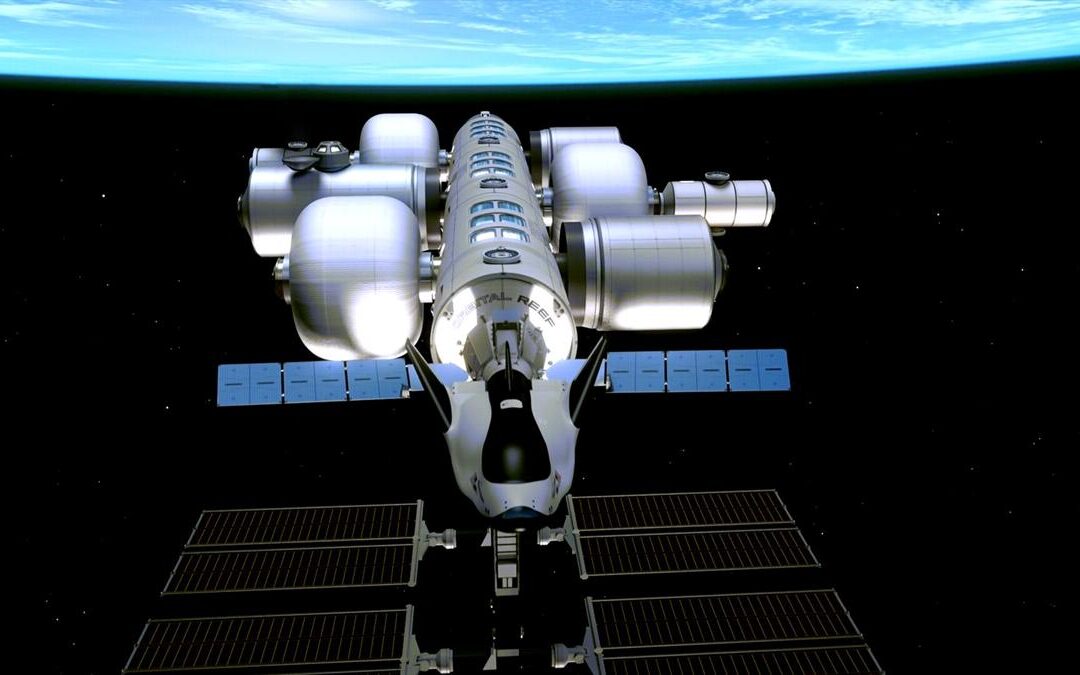

The company, now valued at $4.5 billion, is building a reusable orbital spaceplane called the Dream Chaser.

The Series A investment of primary capital was “the first capital raise for the company and the second-largest private capital raise globally in the aerospace and defense sector ever,” according to a release.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

Leading the campaign was funds and accounts managed by BlackRock Private Equity Partners and AE Industrial Partners, the release states.

It is also partnering with the space exploration company Blue Origin, founded by Amazon CEO Jeff Bezos, to develop a commercial space station.

“We are building the next generation of space transportation systems and in-space infrastructures and destinations that will enable humanity to build and sustain thriving civilizations beyond Earth,” Tom Vice, Sierra Space’s chief executive, said in a statement.

Sierra Nevada Corp. broke off its space program now known as Sierra Space in April. Sierra Space has 1,100 employees, according to the release.

“We have worked hard for years to nurture the Sierra Space business from its genesis in 2008 to today, where it has significantly grown to hold a very unique and strategic position in the rapidly expanding commercial space sector,” said Fatih Ozmen, chariman of the Sierra Space Board of Directors and CEO of Sierra Nevada Corp. in a release. “Sierra Space now has the right scale, and with its leading-edge technologies and turnkey capabilities is poised to significantly accelerate growth with this investment.”

Source: Denver Gazette

Can’t stop reading? Read more

Private investors hold $140tn, Moonfare says private equity access is still only “five minutes into a 90-minute movie”

Private investors hold $140tn, Moonfare says private equity access is still only “five minutes...

Trump approves $14bn TikTok US spin-off with Oracle, Silver Lake, and KKR as investors

Trump approves $14bn TikTok US spin-off with Oracle, Silver Lake, and KKR as investors President...

Patriots score $9bn valuation as Sixth Street and Metropoulos acquire 8% stake

Patriots score $9bn valuation as Sixth Street and Metropoulos acquire 8% stake Robert Kraft has...