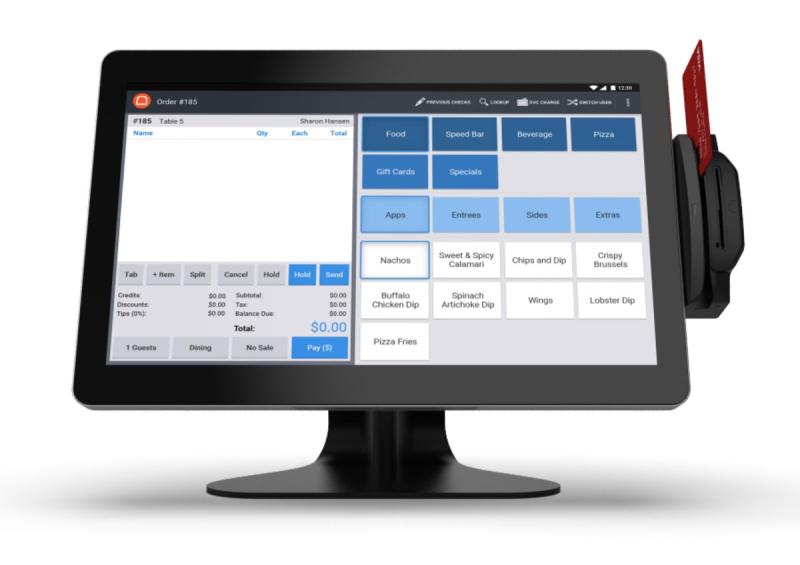

Toast Inc., which makes point-of-sale technology for restaurants, raised $400 million at a $4.9 billion valuation in a fundraising round led by investors including Bessemer Venture Partners and TPG.

Other investors that led the funding round are Tiger Global Management and Greenoaks Capital, according to a statement.

Toast’s new valuation is a leap from $2.7 billion in April when it raised $250 million in April. Toast said it would use the money to invest in its technology and fund research and development.

“We’re at the stage when companies would consider going public, but we’re not in any rush yet,” Toast Chief Executive Officer Chris Comparato said in an interview. “Going public is a milestone and we want to have certain projects under our belt as a private company.”

Another player in the restaurant software space, Olo, is preparing for an initial public offering later this year, Bloomberg News has reported.

While Comparato declined to provide details on a potential IPO for his company, he said, “Toast will be a large independent public company that will power the restaurant community for decades.”

‘Investing Ahead’

Boston-based Toast, which has 3,000 employees, saw its revenue grow 109% last year and remains unprofitable, Comparato said.

“We aren’t profitable yet because we’re investing ahead because of the demand we see coming,” he said.

Other investors in the round included TCV, G Squared and funds and accounts advised by T. Rowe Price Associates.

Toast was was launched in 2013 by former executives at Endeca Technologies Inc., another Boston-area tech company that was acquired by Oracle Corp. in 2011, reportedly for more than $1 billion. Toast also competes with Micros Systems, a point-of-sale company acquired by Oracle in 2014 for $5.3 billion.

The company focuses on selling its software to smaller and midsize restaurants with up to nine locations but also has deals with larger chains such as Jamba Juice Co.

Source: Bloomberg

Can’t stop reading? Read more

Missoni family passes baton as FSI takes control of €130m fashion house

Missoni family passes baton as FSI takes control of €130m fashion house FSI has become the...

Silver Lake-backed TKO launches $900m loan after $150m dividend

Silver Lake-backed TKO launches $900m loan after $150m dividend TKO Group Holdings, backed by...

Waterland targets cross-border growth with Palletways acquisition

Waterland targets cross-border growth with Palletways acquisition Waterland Private Equity has...