Subscribe to our Newsletter to increase your edge. Don’t worry about the news anymore, through our newsletter you’ll receive weekly access to what is happening. Join 120,000 other PE professionals today.

“These markets are experiencing rapid growth as the United States increases its focus on new architectures to enhance the survivability and resiliency of its national security space assets,” said ATL partner Sanjay Arora.

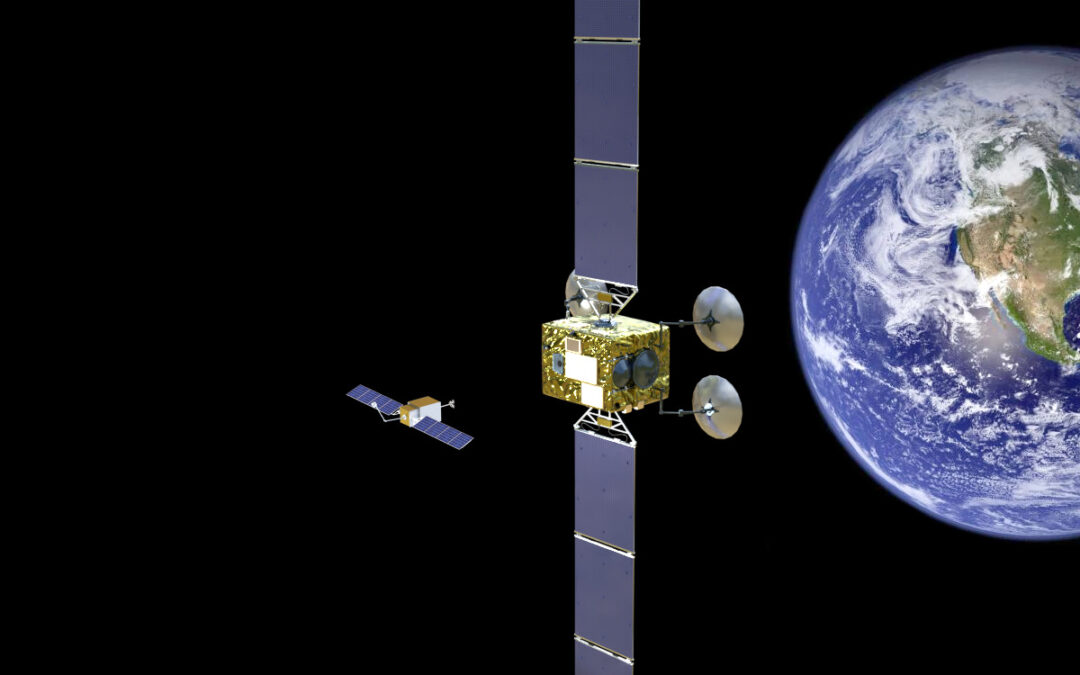

Hartman said Geost plans to ramp up development and manufacturing of EO/IR payloads in anticipation of growing demand from DoD and the intelligence community. “There is a recognized need for protection of space assets and space domain awareness” which means more sensors, said Hartman. “There will be a need for affordable systems to protect the entire national security space architecture.”

The Space Development Agency, the Missile Defense Agency, the U.S. Space Force, the National Reconnaissance Office and others are looking to deploy proliferated constellations in low Earth orbit, Hartman noted. Geost wants to position itself of be a payload provider for surveillance, missile warning and other military satellites. “So we’ll need to build out our production facilities and build our engineering base in order to accommodate the demand for proliferated LEO systems.”

“We’re going to invest in engineering capacity in Tucson and Washington, but we’re also looking at offices in other areas like the Colorado Springs or Huntsville [Alabama]. Maybe Albuquerque [New Mexico],” he said. “These are areas where our customers are and where there’s strong engineering talent that we can tap into.”

Hartman said ATL Partners intends to build up its national security space portfolio and make additional acquisitions in this sector.

Source: Space News

Can’t stop reading? Read more

Fund Friday: Top fundraising news in private equity

Fund Friday: Top fundraising news in private equity Aquilius Investment Partners, a...

KKR powers past $723bn AUM on record fundraising and historic investment pace

KKR powers past $723bn AUM on record fundraising and historic investment pace KKR & Co. posted...

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio

Ardian to acquire 90% stake in Centrotherm, boosting European semiconductor portfolio Ardian has...