Two groups of private-equity firms are through to the next round in the heated takeover battle for Thyssenkrupp AG’s $17 billion elevator business, a sale which could rank as one of the biggest deals globally this year. The shortlist of potential buyers consists of a...

Two groups of private-equity firms are through to the next round in the heated takeover battle for Thyssenkrupp AG’s $17 billion elevator business, a sale which could rank as one of the biggest deals globally this year. The shortlist of potential buyers consists of a...

Philip Falcone is in the crosshairs of an activist investor who wants to remove him — along with the rest of the board — from HC2 Holdings Inc. MG Capital, run by former Third Point executive Michael Gorzynski, wrote in a letter to shareholders Tuesday...

Philip Falcone is in the crosshairs of an activist investor who wants to remove him — along with the rest of the board — from HC2 Holdings Inc. MG Capital, run by former Third Point executive Michael Gorzynski, wrote in a letter to shareholders Tuesday...

BlackRock (BLK.N), the world’s biggest asset manager, has appointed two executives to oversee its operations in continental Europe as part of efforts to expand in the region, a memo to staff on Wednesday seen by Reuters showed. BlackRock has accelerated its investment...

BlackRock (BLK.N), the world’s biggest asset manager, has appointed two executives to oversee its operations in continental Europe as part of efforts to expand in the region, a memo to staff on Wednesday seen by Reuters showed. BlackRock has accelerated its investment...

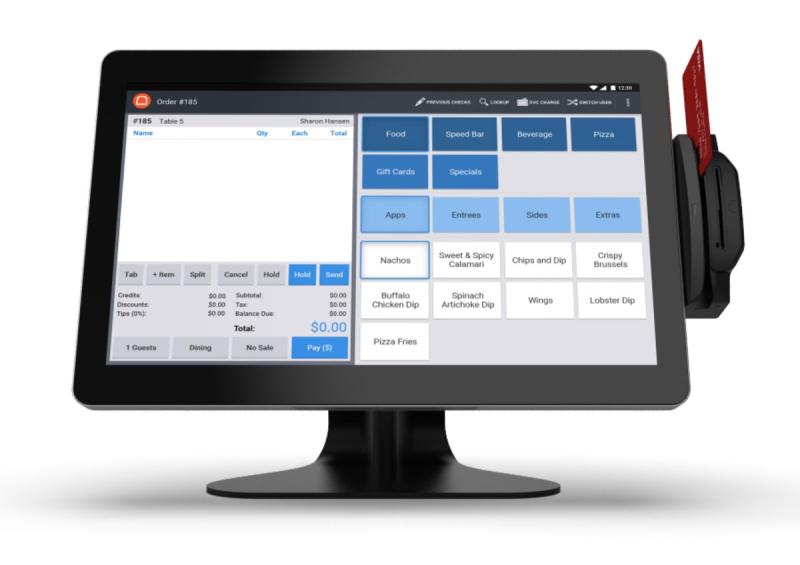

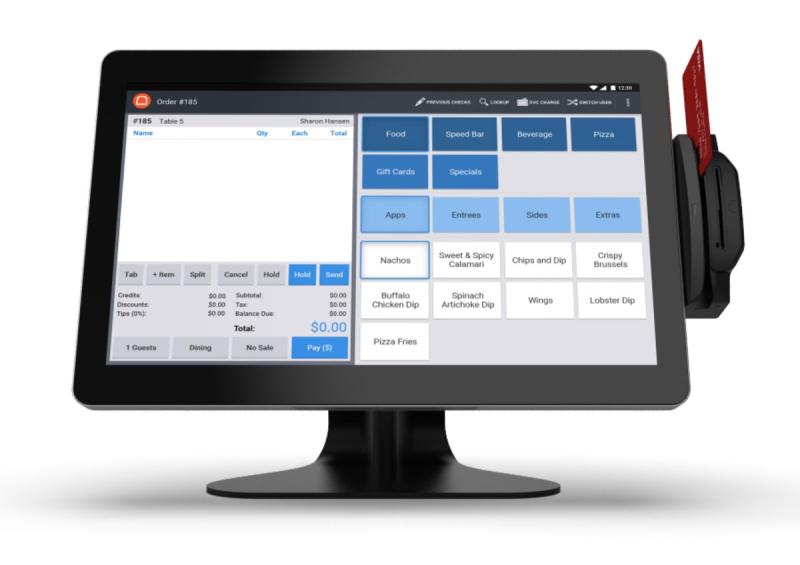

Toast Inc., which makes point-of-sale technology for restaurants, raised $400 million at a $4.9 billion valuation in a fundraising round led by investors including Bessemer Venture Partners and TPG. Other investors that led the funding round are Tiger Global...

Toast Inc., which makes point-of-sale technology for restaurants, raised $400 million at a $4.9 billion valuation in a fundraising round led by investors including Bessemer Venture Partners and TPG. Other investors that led the funding round are Tiger Global...

That it’s become mainstream for large investors seeking attractive risk/return trade offs beyond traditional markets should not be lost on retail investors. A decade ago private equity was considered to be a fringe asset class but today it is generally accepted...

That it’s become mainstream for large investors seeking attractive risk/return trade offs beyond traditional markets should not be lost on retail investors. A decade ago private equity was considered to be a fringe asset class but today it is generally accepted...