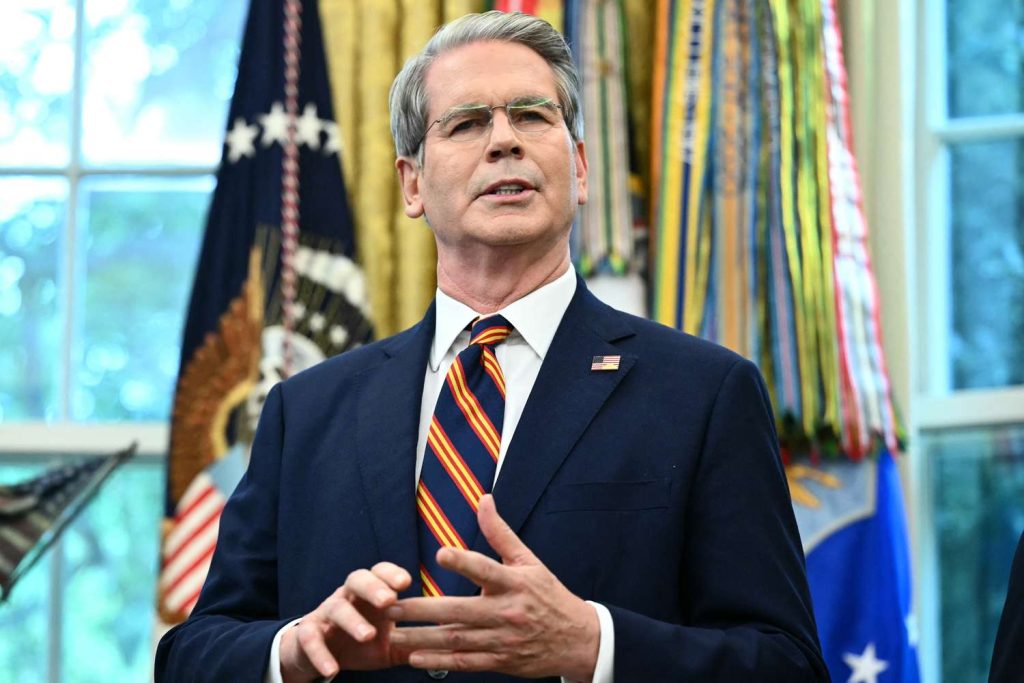

US rules to curb institutional home buying won’t force PE sales, Bessent says

Private equity firms will not be forced to sell existing single-family homes under proposed US measures aimed at curbing institutional ownership, according to Treasury Secretary Scott Bessent.

Speaking after remarks to the Economic Club of Minnesota, Bessent said President Donald Trump’s proposal would be forward-looking and would not require investors to unwind current holdings. “The idea here is bygones are bygones,” Bessent said. “We’re not going to have a forced sale here.”

The proposal would seek to ban institutional investors from purchasing single-family homes in the future, as part of a broader effort to address housing affordability ahead of the US midterm elections. Bessent said the administration’s objective is to “push out the marginal buyer” and prioritise traditional individual owners.

Officials are still considering the structure of the policy, including thresholds that could define when an investor becomes an aggregator, potentially based on ownership of a dozen or two dozen homes. The administration also wants to ensure families who rent homes to relatives are not affected.

Bessent said large financial institutions began acquiring single-family housing stock in the aftermath of the global financial crisis, when private equity firms were among the few buyers with sufficient liquidity. He added that tax advantages, including depreciation and expensing, have supported continued institutional investment in the sector.

The comments provide clarity for private equity and real estate investors amid rising political scrutiny of institutional ownership in US housing markets.

If you think we missed any important news, please do not hesitate to contact us at [email protected].

Can`t stop reading? Read more.