Top website builder and web hosting company Squarespace has revealed it will go after a direct listing this year rather than a traditional initial public offering, according to a Bloomberg report citing people familiar with the matter. Private-equity firm General Atlantic holds 9.9% of the company’s voting power.

The New York company, which provides tools for consumers and businesses to create websites and online stores, didn’t specify a number of shares that it was registering in the filing, but said it had about 73.8 million class A common shares and roughly 64.8 million class B shares.

With the decision to choose a direct listing, Squarespace will be saving money on banking fees and saving time that would have otherwise been spent at investor roadshows, which is a common practise in a traditional IPO.

TechRadar Pro has reached out to Squarespace for comment, but the company is yet to respond.

Compared to an IPO, a direct listing will mean that Squarespace will have no new shares created and only existing, outstanding shares will be sold with no underwriters involved.

The underwriter works closely with the company throughout the IPO process and decides on the initial offer price of the shares. Underwriters usually charge a fee per share, which may range anywhere from 3% to 7% – a fee that Squarespace will save with its direct listing choice.

A month ago, Squarespace raised an additional $300m in its latest round of funding and the firm is now valued at $10bn.

Founded in 2003 by CEO Anthony Casalena, the company also unveiled its plans to go public at the start of the year.

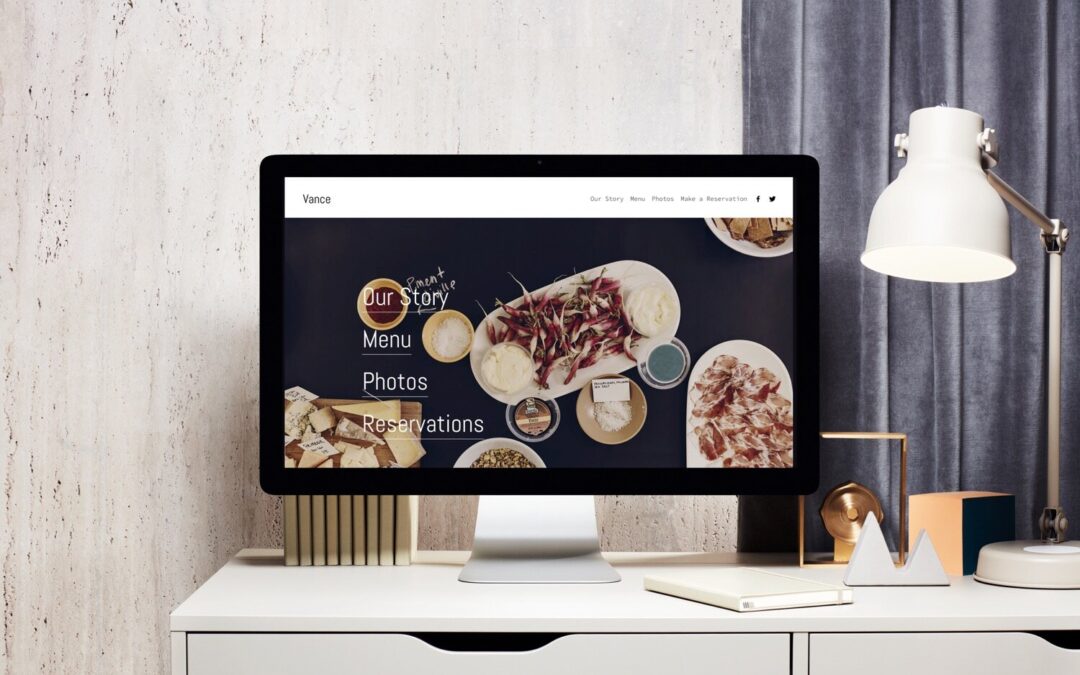

Squarespace has expanded into the e-commerce market and has recently acquired Tock, a unified system serving the hospitality industry with online reservations, table management, takeout, and events.

Source: Tech Radar